WASHINGTON (AP) -- President Barack Obama vetoed a bill Friday that would cap the taxpayer-funded expense accounts of former presidents.

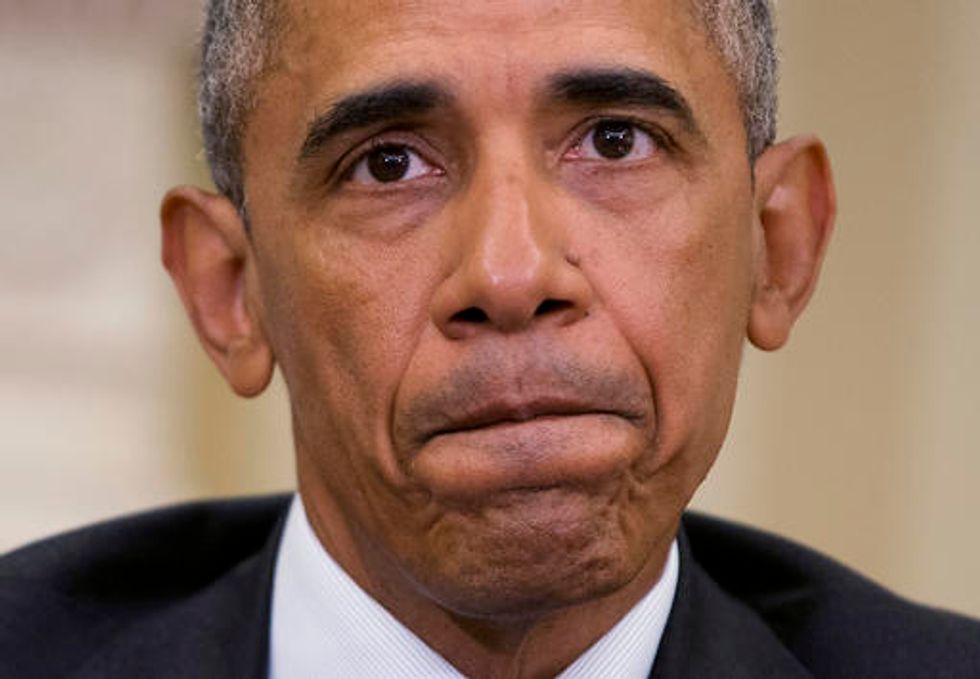

President Barack Obama at the White House in Washington, Thursday, May 19, 2016, to award National Medals of Science and National Medals of Technology and Innovation to 17 scientists, engineers, mathematicians and innovators. (AP Photo/Carolyn Kaster)

President Barack Obama at the White House in Washington, Thursday, May 19, 2016, to award National Medals of Science and National Medals of Technology and Innovation to 17 scientists, engineers, mathematicians and innovators. (AP Photo/Carolyn Kaster)

Obama said he supports the bill's goal, but he sent the measure back to Congress because it would immediately end salaries and benefits to staffers carrying out the official duties of former presidents. He says the measure doesn't provide enough time for these employees to be moved to another payroll.

Obama says the bill would also interfere with the Secret Service's ability to protect ex-presidents.

He offered to work with lawmakers and the offices of the former presidents to change the bill in ways that would eventually earn his signature.

The legislation sets an annual allowance of $200,000 a year for travel, staff and office costs that have become a standard part of life after the Oval Office. For former presidents who make money through books, speaking fees and other ventures, the allowance is reduced by $1 for every dollar in outside income above $400,000.

Both Bill Clinton and George W. Bush, like former presidents before them, have earned millions in speaking fees since leaving office.

The legislation sets presidential pensions at $200,000 a year, nearly the same as the current amount. Each surviving spouse would be allotted a $100,000 annual survivor benefit.