© 2026 Blaze Media LLC. All rights reserved.

At the risk of having to recant later this positive analysis, conservatives might have something to celebrate at Thanksgiving. A tax cut … if you can keep it. But as always, wait for the catch. If this is a ruse to get conservatives to support a bailout of the insurance cartel, then even a legitimate tax cut is not worth the price. Even when a piece of steak is dangled before us, there is always a string in the back to yank it away from us.

The stupidity of GOP leaders is what forced them into an untenable catch-22 that gave them no choice but to accede to minimal conservative demands on both taxes and health care. Given that Republicans refused to repeal Obamacare and cut spending, the revenue box they created for themselves made their tax plan a tax increase and a political liability. They needed more revenue to prop up this excrement sandwich, and the only way they could find another few hundred billion dollars was to repeal the individual mandate of Obamacare. It may be the way out, because repealing the mandate would open the door to collapsing Obamacare while also saving enough money to restructure the convoluted tax plan into a decent tax cut. For now, it’s a small mission accomplished … but then comes the catch.

Let’s go through the good provisions:

The insurance cartel members lose their mandate on the American consumer

To be clear, repeal of only the individual mandate is not a fulfillment of the promise to repeal Obamacare. The main drivers of the market destruction are the regulations and subsidies, which remain in place. The massive Medicaid expansion has also lined the pockets of the insurance and hospital cartels, further fueling their artificial monopoly on health care. However, at this point, conservatives can make repeal of the mandate work in an unconventional way, collapse the entire corrupt insurance cartel system, and open up a competing system. With monthly premiums now up to $2,100 and beyond, once the mandate to purchase is eliminated, the scam is over. The cartel will either have to innovate to compete, lobby for the elimination of the regulations, or face competition from alternative health care models — something that cannot happen until the mandate is repealed. (I’ve explained this in a previous article.)

However, this is all contingent on conservatives blocking any parallel agreement to bail out the insurance cartel. If Congress passes a bailout alongside the repeal, it would negate the benefit of repealing the individual mandate.

Everyone gets a tax cut; families get a significant cut

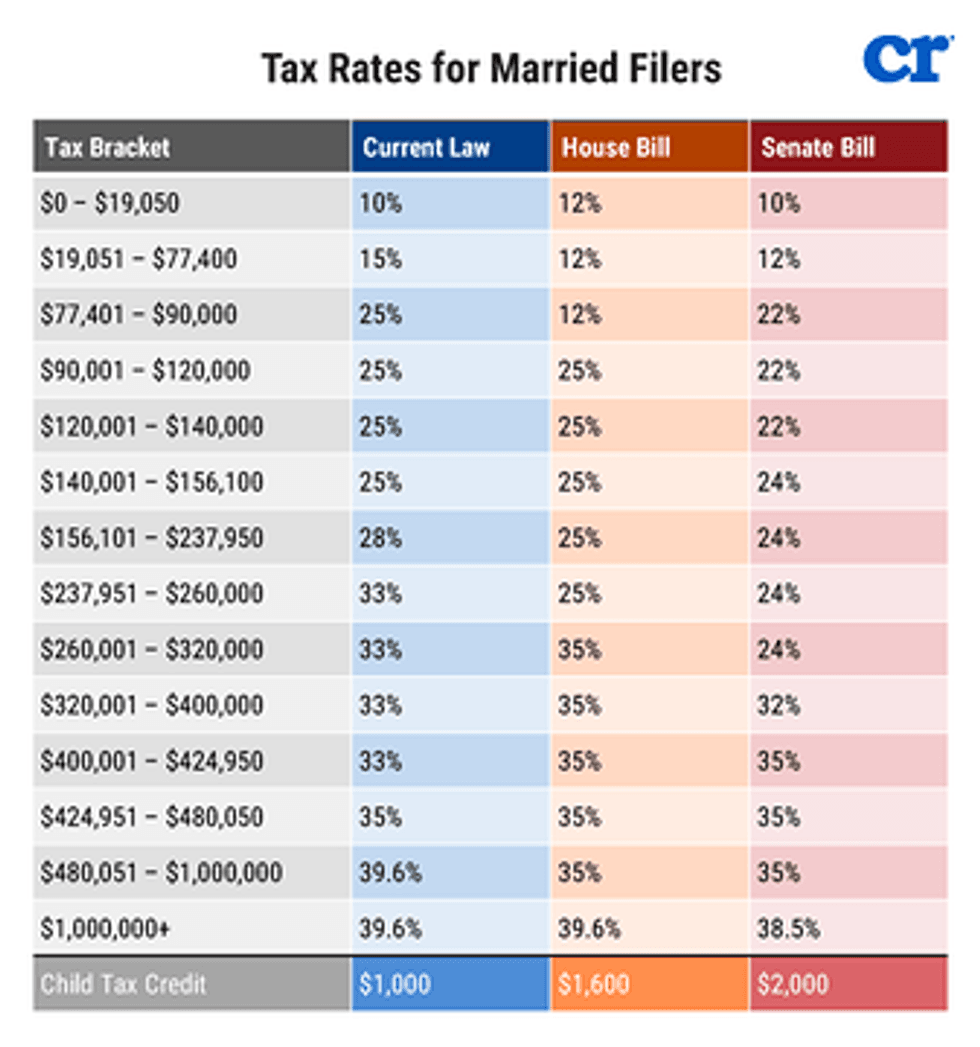

The most important element of a tax cut plan is to actually cut taxes. The problem with the House bill is that many wouldn’t even get a net tax cut and others would get only an insignificant cut. The structure of the revised Senate version, with the reduced rates and the massive expansion of the child tax credit from $1,000 per child to $2,000, will ensure that everyone gets a significant cut, even after getting rid of deductions. Thus, it achieves goals of both cutting taxes and eliminating market distortions. Also, the child tax credit will be a large cut for all families, as the Senate bill raises the phase-out level to $500,000 of combined income. Under current law, it begins phasing out at just $110,000, and under the House bill at $230,000.

It’s true that the Senate bill still restrains tax bracket creep to the “chained CPI,” resulting in less of a cut over time as inflation grows. Conservatives should fight to eliminate this provision because it could be a Pandora’s box in the future. But the cut is still significant enough that it’s worth it for now, even if they insist on keeping this provision.

Economic growth and budget tradeoffs are worthwhile

The major difference in the Senate bill is that whereas the original House version had $3.3 trillion in cuts to the individual tax burden but essentially cancelled them out with almost the same level of increases, the Senate bill cuts individual taxes by $3.7 trillion and raises revenue by only $2.8 trillion.

Where did the extra revenue come from — over and beyond the $300 billion from repealing the individual mandate?

On the one hand, the corporate tax cut is delayed for a year but then made permanent thereafter. The individual tax cuts are enacted immediately but then sunset in 2025. I know many of you will think this is a trap, but the reality is that there is no way the individual cuts for most people will be allowed to sunset. Moreover, it’s the right choice to make the corporate tax cuts permanent, because without the long-term certainty, we won’t see any growth from that reform. Furthermore, the capital expensing component of the corporate tax reform will be enacted immediately. It’s just a shame Republicans and the president have done a poor job building the case that businesses are jobs, wages, and cheaper goods and services, not just opulent citadels of wealth for evil, greedy businessmen.

So, yes, in the long run, this is a much bigger tax cut than the 10-year window suggests. Yes, even with some economic growth, it will blow a hole in the deficit. But Congress was doing that anyway. The choices for conservatives were no spending cuts and a fake tax cut vs. no spending cuts and a real tax cut. All things equal, in this environment of doom and gloom, I’ll take anything I can get.

But … here’s the problem

It was already announced that Republicans also plan to pass the Alexander-Murray insurance cartel bailout in exchange for repeal of the individual mandate. Not only does a bailout cancel any benefit of repealing the individual mandate, as it perpetuates the very monopoly we are trying to break, it makes the entire tax plan not worthwhile. To begin with, this tax plan is nothing earth-shattering, and over time, the adjusted calculation of inflation will reverse most of the cuts within 10-15 years. Health care, on the other hand, is the issue of our time. The only way to make the system work like a functioning market with price transparency is to end the stranglehold of the insurance cartel on health care. Any tax plan that harms our ability to fix health care is just not worth it.

Moreover, I’m concerned whether this tax plan is really worth the political price we will pay for it. The expectations have become so low that passage of any moderately conservative policy will be heralded as a breakthrough. Conservative members will feel such gratitude for leadership abiding by the party platform for once that they will feel the need to give leadership a long leash just a couple weeks later in December, when the world comes crashing down around us. Congress will massively increase spending in the omnibus, raise the debt ceiling again, pass amnesty, and enact yet another bailout for Puerto Rico. And of course, the insurance cartel bailout. If that is the plan, then this tax bill is nothing more than the peanut butter in the mousetrap.

Furthermore, here’s the sad reality of trying to force leadership into a few conservative ideas that are then messaged through the toxic megaphone of the GOP. Because Republicans have spent the past few months aimlessly talking about undefined “tax reform” rather than massive across-the-board cuts for all families, they have pre-emptively carpet bombed our messaging on an otherwise decent tax cut. The bill is already as unpopular as their health care bill from earlier this year because it was messaged for weeks as a potential tax increase.

This is why we can’t have nice things. The GOP bombs conservative plans and messages before they can even get out of the gate. That is the grim future of a movement that refuses to find a home that welcomes it even with one arm.

Want to keep up with what's going on in Washington without the liberal media slant, establishment spin, and politician-ese?

Sign up to get CRTV’s Capitol Hill Brief in your inbox every evening! It’s free!

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

Blaze Podcast Host

Daniel Horowitz is the host of “Conservative Review with Daniel Horowitz” and a senior editor for Blaze News.

RMConservative

Daniel Horowitz

Blaze Podcast Host

Daniel Horowitz is the host of “Conservative Review with Daniel Horowitz” and a senior editor for Blaze News.

@RMConservative →more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2026 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.