© 2026 Blaze Media LLC. All rights reserved.

"...after which time it will be 'too late'"

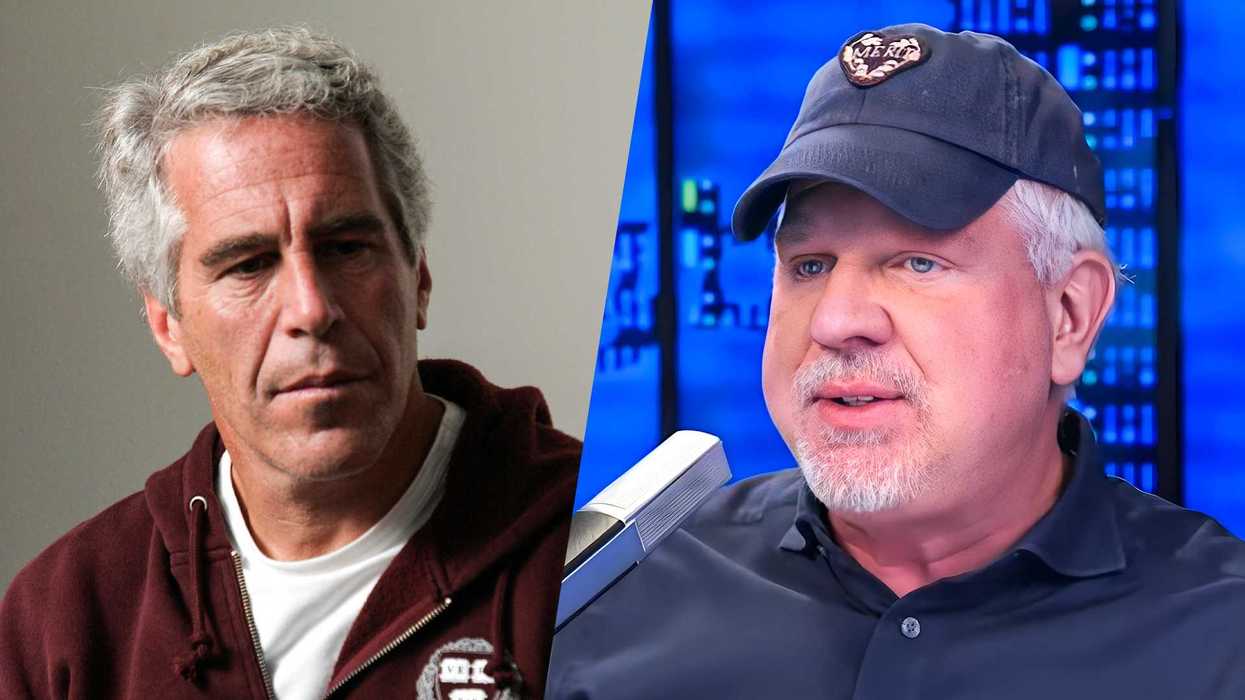

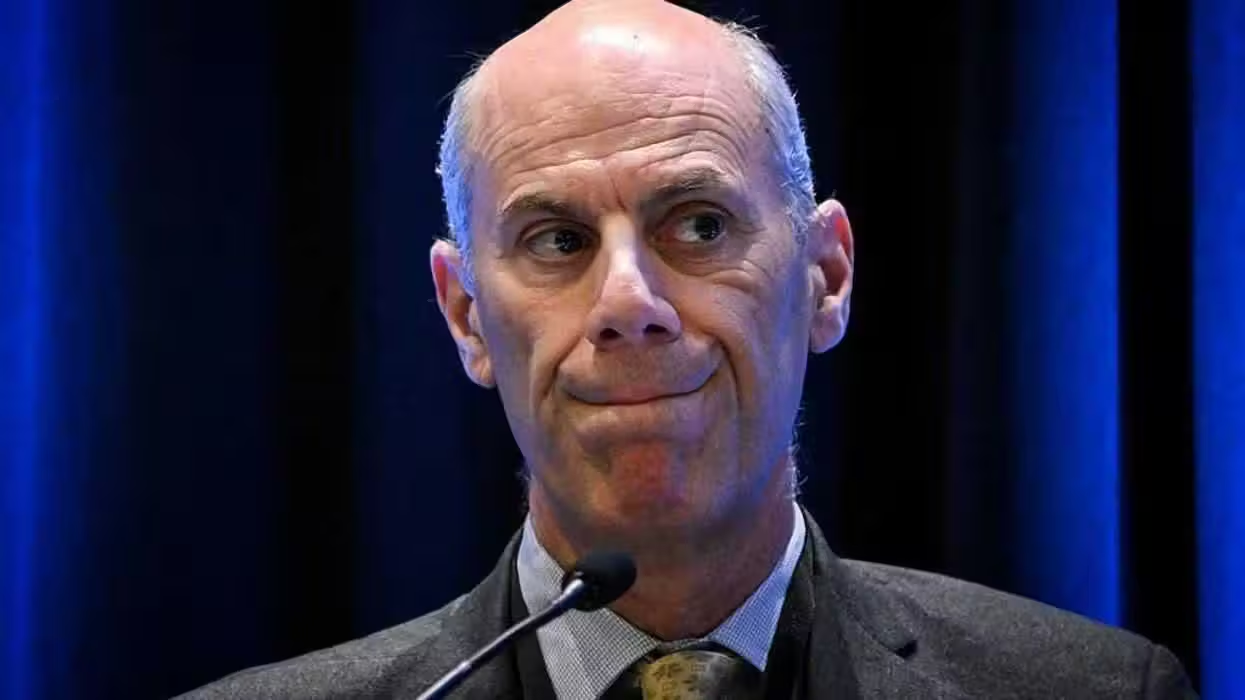

George Soros, a billionaire investor who in part made his fortune by predicting economic trends, delivered a speech today in Trento, Italy where he said that Europe has three months to rectify the Eurozone crisis, after which time it will be "too late."

George Soros, a billionaire investor who in part made his fortune by predicting economic trends, delivered a speech today in Trento, Italy where he said that Europe has three months to rectify the Eurozone crisis, after which time it will be "too late."

Known as the man who "broke the bank of England," Soros continued to predict a type of "lost decade" for Europe as seen in Latin America in the 1980s.

"A similar fate now awaits Europe. That is the responsibility that Germany and other creditor countries need to acknowledge. But there is no sign of this happening," he said.

Soros continued, explaining: "The Greek crisis is liable to come to a climax in the fall. By that time the German economy will also be weakening so that Chancellor (Angela) Merkel will find it even more difficult than today to persuade the German public to accept any additional European responsibilities. That is what creates a three-month window."

Soros' entire speech can be seen on his personal website, and by all accounts, it is worth watching.

Reuters describes the rest of the speech:

The Hungarian-born U.S. financier said that all the "blame and burden" of adjusting the euro area's imbalances was falling on weaker peripheral countries, but the bloc's core bore an ever greater responsibility for the crisis.

"The 'centre' is responsible for designing a flawed system, enacting flawed treaties, pursuing flawed policies and always doing too little too late," he said.

Soros urged creating a European deposit insurance scheme and called for direct bank access to the euro zone's rescue fund, as well as for joint financial supervision and regulation.

He also called for measures to lower borrowing costs of heavily indebted countries, warning that if this did not happen support for reforms in Italy would wane, making it difficult for the government to carry them out.

"There are various ways to provide it (a fall in funding costs), but they all need the active support of the Bundesbank and the German government," he said.

The euro zone would eventually need a financial authority that could take over much of individual countries' solvency risk.

Translated into colloquial English, this all essentially means-- "Germany needs to fork over more money, and European nations should be further linked in an 'open society' through financial and economic measures."

Soros ends with a plea: "We need to do whatever we can to convince Germany to show leadership and preserve the European Union as the fantastic object that it used to be. The future of Europe depends on it."

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2026 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.