Photo Credit: Shutterstock

A government watchdog is reporting that more than 300,000 people have received hundreds of millions of dollars in excess subsidies to buy health insurance under Obamacare, and will have to return those extra payments.

The Treasury Department's Inspector General for Tax Administration reported that as of late February, the IRS had processed 737,148 tax returns from people who claimed a "premium tax credit" under Obamacare. Those credits are the way the law subsidizes low-income people who are required to buy health insurance.

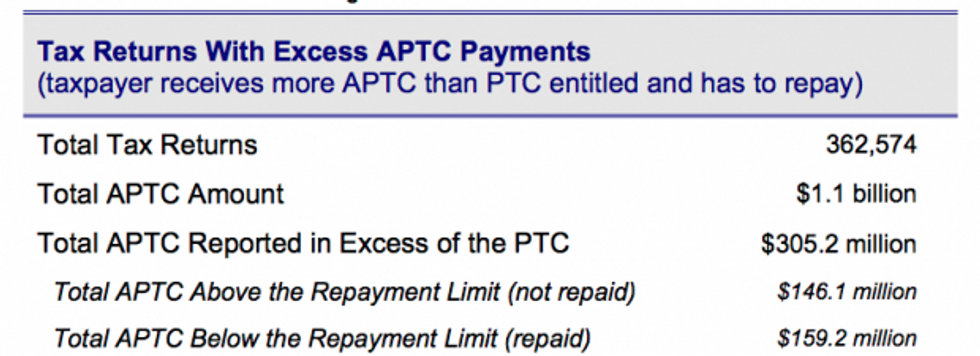

Of those returns, 362,574 of them reported being given more of a subsidy than they deserved — that's 49 percent of all returns claiming the credit through February.

When all the overpayments are added up, it comes to $305.2 million, the report said. That's an average of about $840 per person in excess subsidies.

As of February, about half of that $305.2 million had been repaid, and half had not, the report added.

It's been known for more about a year that officials implementing Obamacare were having problems with the premium tax credit that will help millions of people afford to buy health insurance under the law. Since early 2014, Rep. Diane Black (R-Tenn.) and others have said the administration needs to do more to verify the eligibility of people taking these subsidies, to ensure there are not huge overpayments.

Under Obamacare, people can qualify for tax subsidies if they earn anywhere from the federal poverty level and four times that amount. The less people make, the more subsidy they receive.

But because the subsidy is given out in advance, it can lead to complications when people file their taxes. If their income rose during the year, for example, they could be in a position of having received too much of a subsidy, and they may have to pay some of it back.

The IG report said only about 90,000 of the returns claiming an Obamacare tax credit received the amount of subsidy they should have received, or about 12 percent.

The remaining 38 percent, totaling 285,000 returns, weren't paid enough in subsidies, and will be able to claim another $98 million, the report said.