© 2025 Blaze Media LLC. All rights reserved.

George Soros, Who Says Rich Should Pay More Taxes, May Soon Owe Mind-Boggling Amount to IRS

May 01, 2015

That's a huge number.

Billionaire investor George Soros has joined many on the left in calling for the nation’s richest to pay more in taxes — and he may soon be leading the charge on that front.

In 2008, U.S. Congress closed a lucrative tax loophole which could result in Soros owing at least $6.7 billion in federal, state and local tax, Bloomberg reported.

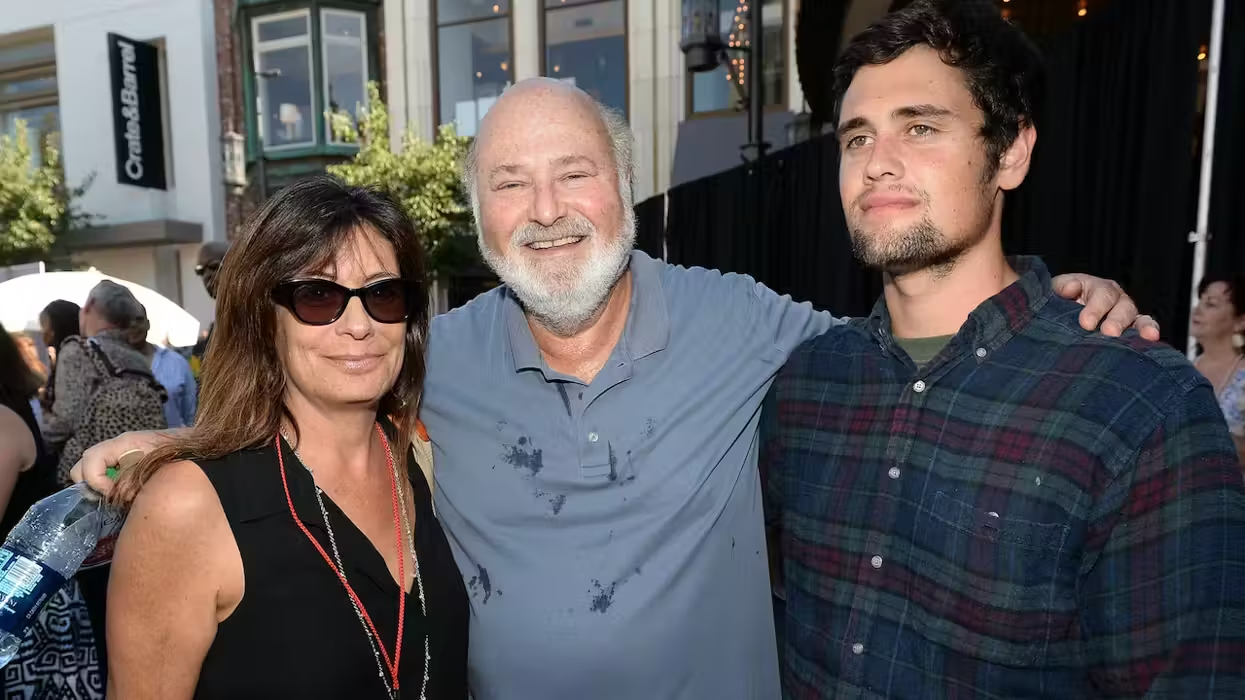

Soros Fund Management Chairman George Soros speaks during a panel discussion at the Nicolas Berggruen Conference in Berlin, Germany, Oct. 30, 2012. (AP Photo/Thomas Peter, Pool)

Soros Fund Management Chairman George Soros speaks during a panel discussion at the Nicolas Berggruen Conference in Berlin, Germany, Oct. 30, 2012. (AP Photo/Thomas Peter, Pool)

The loophole exploited by Soros allowed the billionaire to “defer taxes on fees paid by clients and reinvest them in his fund, where they continued to grow tax-free,” according to the report. Soros Fund Management had reportedly accumulated roughly $13 billion using the tactic as of 2013.

Under legislation passed by lawmakers in 2008, hedge fund managers were given until 2017 to pay the “accumulated taxes” avoided by using the tax deferrals.

Here's an explanation of the numbers behind the $6.7 billion tax figure via Bloomberg:

A New York-based money manager such as Soros would be subject to a federal rate of 39.6 percent, combined state and city levies totaling 12 percent, and an additional 3.8 percent tax on investment income to pay for Obamacare, according to Andrew Needham, a tax partner at Cravath, Swaine & Moore. Applying those rates to Soros’s deferred income would create a tax bill of $6.7 billion. That calculation is based on publicly available information such as the Irish regulatory filings, which provide only a partial glimpse into Soros’s finances. The actual tax bill would be affected by factors specific to the billionaire. Soros declined to comment, according to Michael Vachon, a spokesman, as did Anthony Burke, an IRS spokesman.Just before Congress closed the loophole, Soros transferred assets to Ireland—a country seen by some at the time as a possible refuge from the law. The filings show for the first time the extent to which Soros’s almost $30 billion fortune—he ranks 23rd on the Bloomberg Billionaires Index—came from finding ways to delay taxes and reinvesting the money in his fund.

Read the full report here.

---

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2025 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.