© 2024 Blaze Media LLC. All rights reserved.

IRS watchdog: Only 39 percent of IRS workers who cheated on their taxes had to leave the agency

May 06, 2015

The government's watchdog on the IRS said Wednesday that almost 1,600 IRS employees were found to be "willfully noncompliant" when it comes to paying their taxes over the ten-year period ending in 2013.

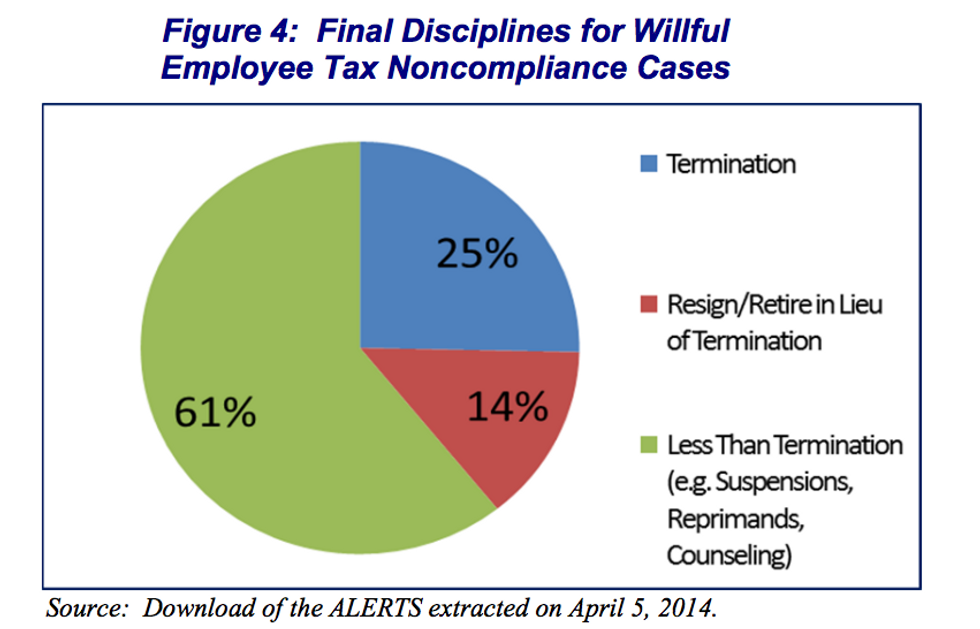

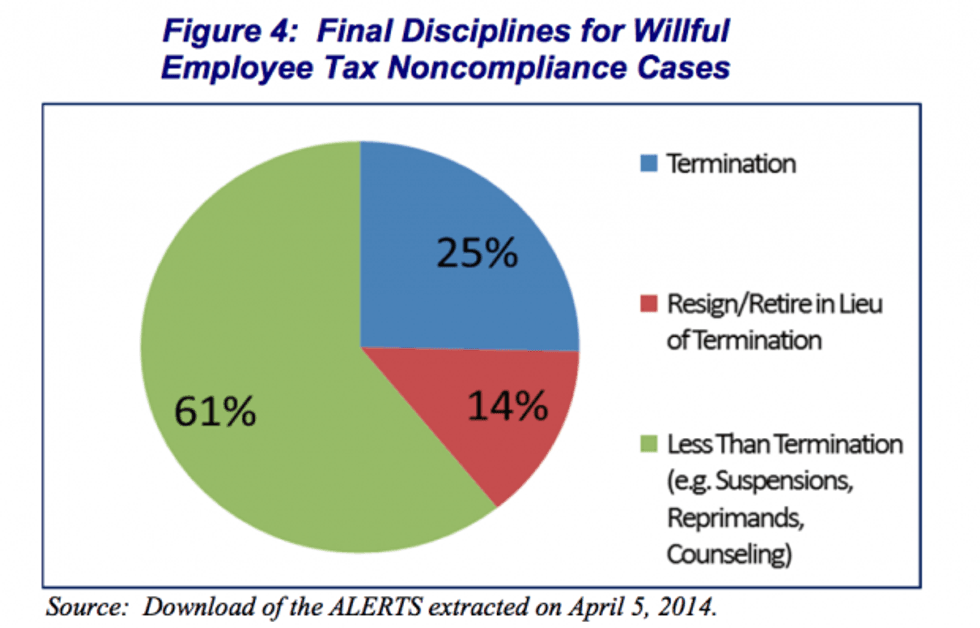

And while the law says the IRS must fire anyone who willfully violates federal tax law, only 39 percent of those people were fired. The rest of the cases — representing 960 employees — were "mitigated to lesser penalties such as suspensions, reprimands, or counseling."

The Treasury Inspector General for Tax Administration, or TIGTA, released a report Wednesday that reviewed the IRS's ability to "address violations of tax law by its own employees." The report said that while the law calls on the IRS to fire willful violators, it also lets the IRS commissioner mitigate cases when he or she wants, and found that the last several commissioners have apparently been using this authority liberally.

"The IRS owes the American people an explanation for this display of bureaucratic incompetence," Rep. Peter Roskam (R-Ill.) said in reaction to the report.

"To argue that budget cuts provide 'a tax cut for tax cheats' while harboring employees who violate the laws they are supposed to enforce quite frankly defies logic," he said. "The gulf of trust between taxpayers and the IRS has never been wider, and the IRS can and must do better."

The report defines a "willful violation" of the tax laws as the intentional failure to file a timely tax return or report accurate information.

In a sample of 34 cases, TIGTA found "different discipline" imposed on these cases, and said it was impossible to say why punishments varied from case to case, or why some punishments were mitigated at all.

"Some employees had significant and sometimes repeated tax noncompliance issues, and a history of other conduct issues," the report said. "Moreover, management had concluded that the employees were not credible."

"Nonetheless, the proposed terminations were mitigated by the IRS Commissioner," it said.

TIGTA recommended that the IRS impose a new requirement to detail how decisions are made on mitigating these penalties. The IRS said it agreed.

The report also found that nonwillful cases of failure to comply with tax laws vastly outnumbered the number of willful cases. In the last 10 years, there were just a few hundred willful cases, but more than 1,000 nonwillful cases.

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

© 2024 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.