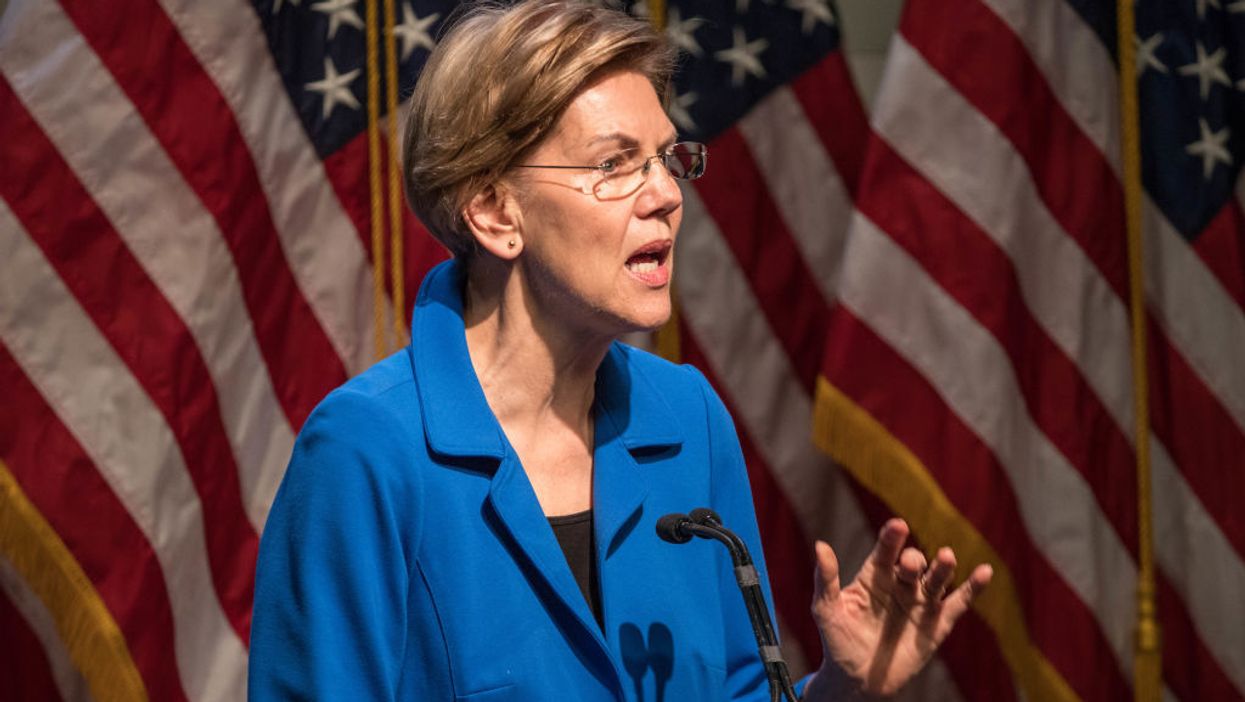

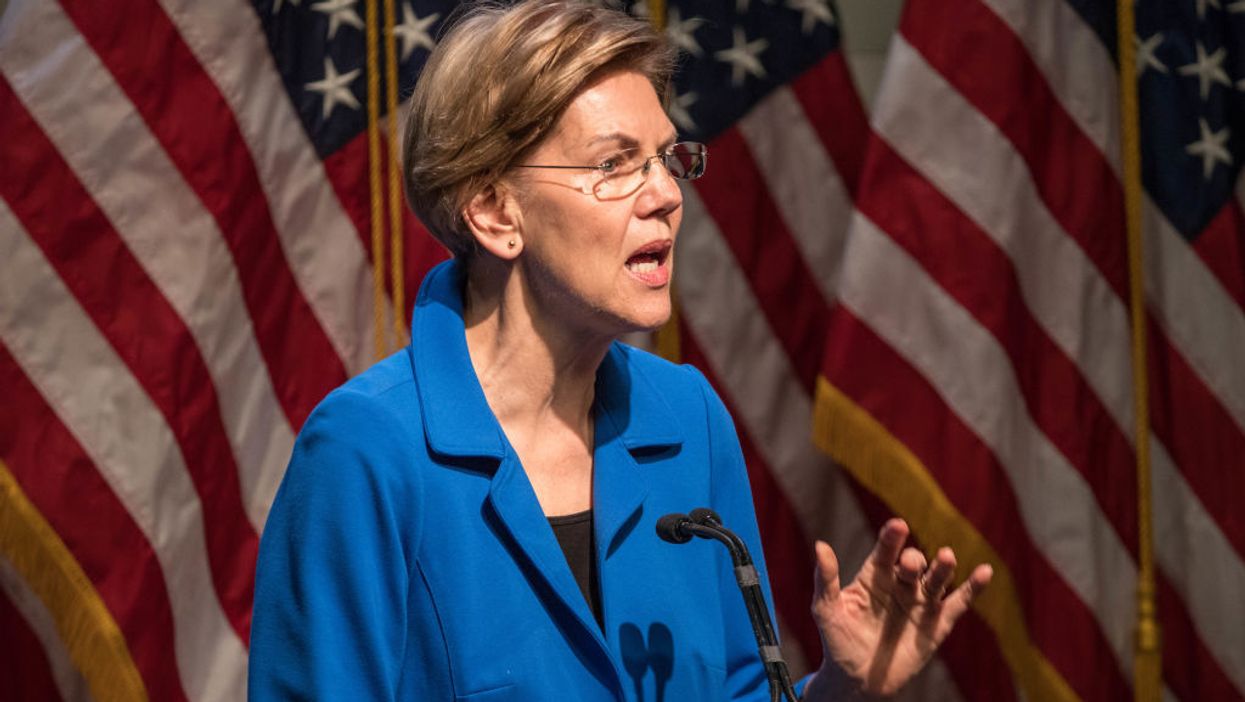

Photo by Scott Eisen/Getty Images

Off by a tick

According to a recent study, the wealth tax plan put forward by Democratic presidential candidate Sen. Elizabeth Warren (Mass.) would raise 30% less than her campaign has estimated.

The Penn-Wharton Budget Model finds that Warren's plan — which would tax wealthy American families at 2% of net worth above $50 million and 6% above net worth above $1 billion — would raise between $2.3 trillion and $2.7 trillion between 2021 and 2030.

Those estimates, which fluctuate based on whether macroeconomic effects are included in the model, are $1.05 trillion to $1.45 trillion less than the figure Warren's campaign has touted: $3.75 trillion. That means the total amount raised would range from 28% to 39% less than the Warren campaign's estimate.

Taxing the rich has been a hotly debated subject in recent political discourse and a pet issue for many populist politicians, like Warren, who desires to use the tax dollars accrued from the rich to pay for entitlement programs like Medicare for All.

In January 2019, Warren proposed a tax on high-net worth American families that would place a tax burden of 2% on net worth above $50 million. As a presidential candidate, she added a 6% tax on net worth above $1 billion to the plan, which is called the "Ultra-Millionaire Tax."

Warren points to "an extreme concentration of wealth" among the very rich in America as the impetus for her plan.

Soon after her January 2019 proposal, several other candidates in the Democratic field, including Sen. Bernie Sanders (I-Vt.), also launched wealth tax plans.

The Penn-Wharton study notes that the constitutionality of a wealth tax is currently being debated by legal scholars and also that wealth tax plans have been tried in other countries, but to no avail.

A Wall Street Journal article on the news records the response of Simon Johnson, an economist at the Massachusetts Institute of Technology and an informal adviser to the Warren campaign.

"You need a big investment in enforcement apparatus, which has been rather depleted — and Warren has got that in her plan," he argued.

Johnson also pushed back against the Penn-Wharton study's assertion that Warren's plan would diminish economic growth in the long run by discouraging investment and consequently raising less revenue by arguing that view doesn't match recent experience with the economy.

"It feels like to me like they're modeling the world of 1992, 1994," he said.

Saloni Sharma, an official campaign spokeswoman, added: "This is an analysis of a different and worse plan than Elizabeth's, using unsupportable assumptions about how the economy works, and its conclusions are meaningless."