Bloomberg/Contributor/Getty Images

The PPP disaster and the student loan disaster are two different disasters. We can try to hold government to account for the messy Paycheck Protection Program without shaming those who used it by the rules.

The newest trend in the student loan forgiveness scheme is to shame those who took out Paycheck Protection Program loans during the COVID-19 pandemic and use them as a benchmark for why student loans should be forgiven. It’s a phony comparison.

First, let’s acknowledge that the U.S. government is the largest predatory lender in the world, preying on young people and enabling a wholesale transfer of wealth from youth to colleges and their administrators. Without a doubt, the government’s role in student lending has been to the detriment of young Americans. That needs to be addressed and fixed.

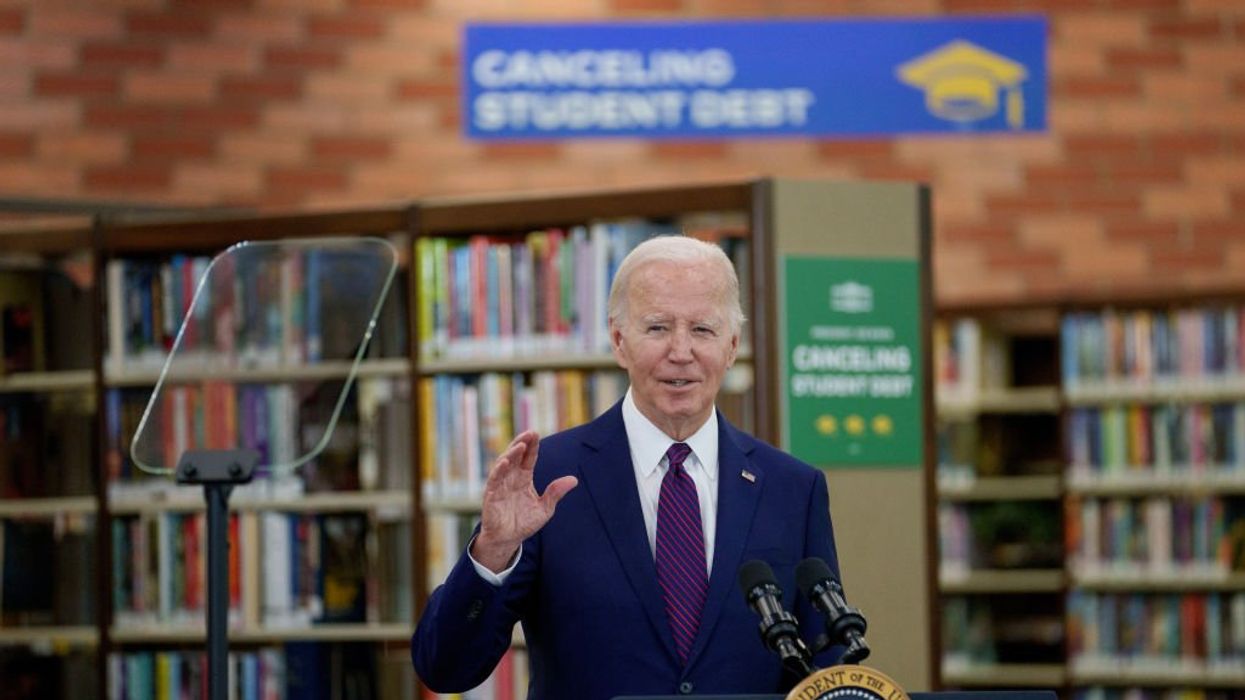

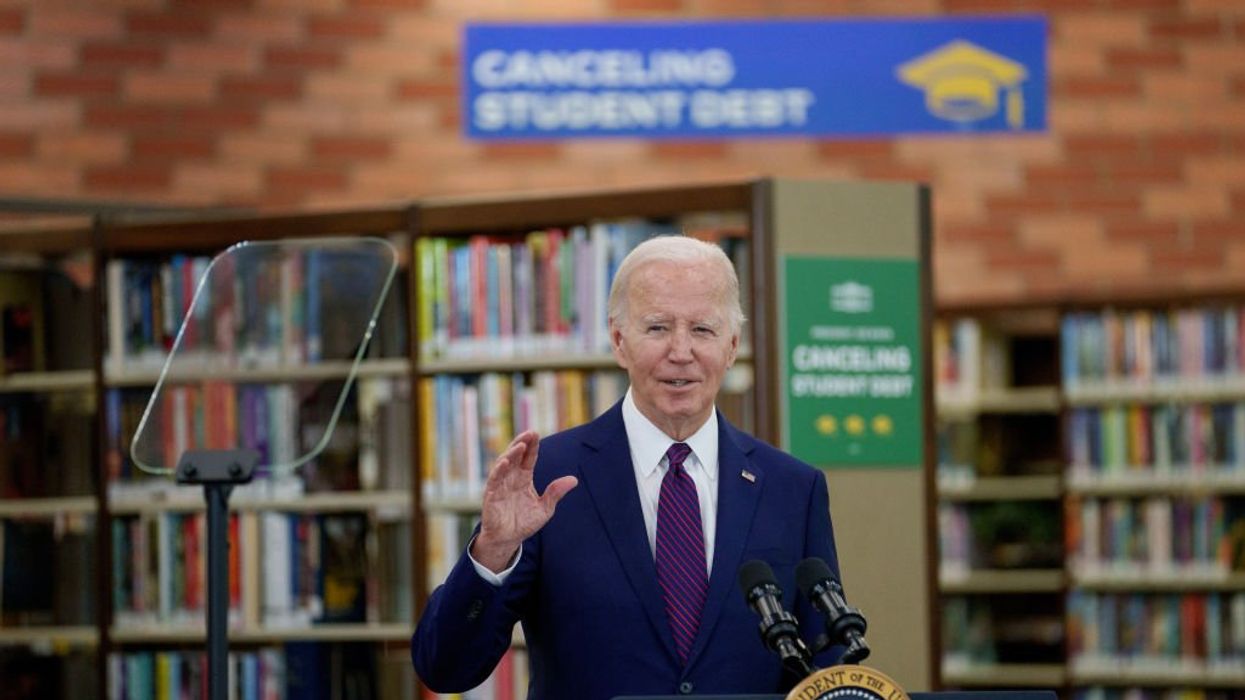

But nobody wants to get to the root of the problem. Joe Biden and the Democrats just want to have a debt jubilee — one that would further enable colleges to keep charging exorbitant tuition for degrees that don’t produce an appropriate return on investment. That not only hurts college grads just starting out in life but also the taxpayer writ large.

Student loan forgiveness isn’t a fix. It’s a wealth transfer.

Progressive Democrats are now saying that PPP loans were “forgiven” and that means young people deserve forgiveness.

This is very much apples and oranges.

There is much to be done to ensure young people aren’t ensnared by five- and six-figure debt for degrees not worth a fraction of that amount.

Mandates from local and state governments shut down mostly small businesses, running into the concept of eminent domain. The government cannot take your property “for the public good” for any period without reasonable compensation. Small businesses were able to get compensation — in many cases, only a fraction of what they were truly due — through the horribly structured PPP program.

The program was structured pretty much from the get-go to be forgivable loans. If you met certain criteria, you understood you would not have to pay the money back.

Some small businesses didn’t take the loans because they didn’t believe the government. Others were angered because of the hoop-jumping loan structure, when other entities, such as the Kennedy Center and various academic institutions, got relief directly and weren’t required to submit to the “loan” farce.

Overall, the program was a disaster. While many small businesses did get part of their due compensation, the program was rife with fraud and, in many cases, didn’t send the money to the right people. The broader CARES Act, and the legislation that followed, spent trillions of dollars in the name of combatting the pandemic emergency.

Individuals got direct stimulus. Renters and students with loans got pauses on their payments. It was a disgraceful free-for-all.

The government lost track of some of its spending, and not enough individuals were held accountable.

That was a horrible period, which was dragged out even longer with Biden’s American Rescue Plan that added more stimulus and ignited inflation to more than 40-year highs.

But the PPP disaster and the student loan disaster are two different disasters. Student loans are personal loans for personal development that are not compensation for the government interfering in private property. Except for the loans set up for forgiveness from the outset (such as those linked to public service), student loans are not taken out with any expectation or promise of forgiveness.

Starting to forgive loans means that those who have paid their loans, who never went to college or who went to cheaper colleges they could afford, will now be forced to shoulder a part of the cost of the highly educated. It is picking winners and losers — which, of course, you could argue the government already does. But that does not mean we should enable more of it.

I am for student loan forgiveness if the colleges who gave out degrees that don’t allow the holders to pay their loans back are on the hook for them.

I am for getting the government out of the student loan business. I am for allowing such debt to be discharged in bankruptcy court and appropriate underwriting of student loans — like just about every other loan on the planet.

There is much that needs to be done to ensure young people aren’t ensnared by five- and six-figure debt for degrees not worth a fraction of that amount.

But these are separate issues. We can try to hold government to account for the messy PPP program without shaming those who used it by the rules.

We can work to fix the college issue for young people. And we can do both in a way that is fair and makes sense.

Carol Roth

Contributor