© 2026 Blaze Media LLC. All rights reserved.

Here Are the New Tax Forms and Worksheets You May Need to Fill Out if You Have Obamacare

January 12, 2015

"If you and/or a member of your tax household are claiming an exemption on your return, complete Part III."

The IRS has created lots of new tax forms that people will need to fill out to keep track of the health insurance coverage they have from Obamacare, as well as forms for figuring out their health insurance tax credit.

The IRS last week noted that Obamacare will make taxes more complicated for some, even though most should be able to simply check off a box on their tax return saying they have qualifying health insurance plan from their company.

Image: AP Photo/Carolyn Kaster

But others who receive Obamacare and need to figure out their exact insurance premium tax credit need to get psychologically ready for new and exciting tax forms.

One of these is a 1095-A form, which you will get in the mail if you get insurance from an exchange. The IRS has created five pages of forms people can use to keep track of what they get from the government.

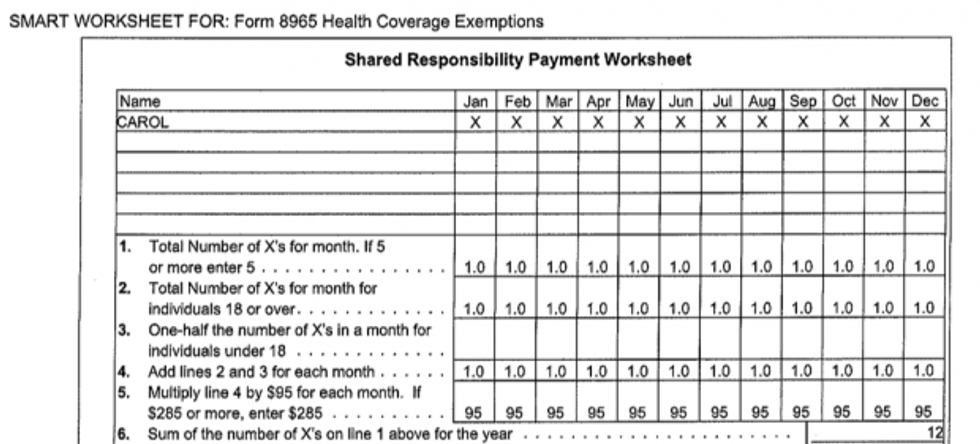

The IRS is encouraging people to fill out these "Smart Worksheets" and keep them for the personal records, to help keep track of their health insurance data throughout the year. One of those worksheets might end up looking something like this:

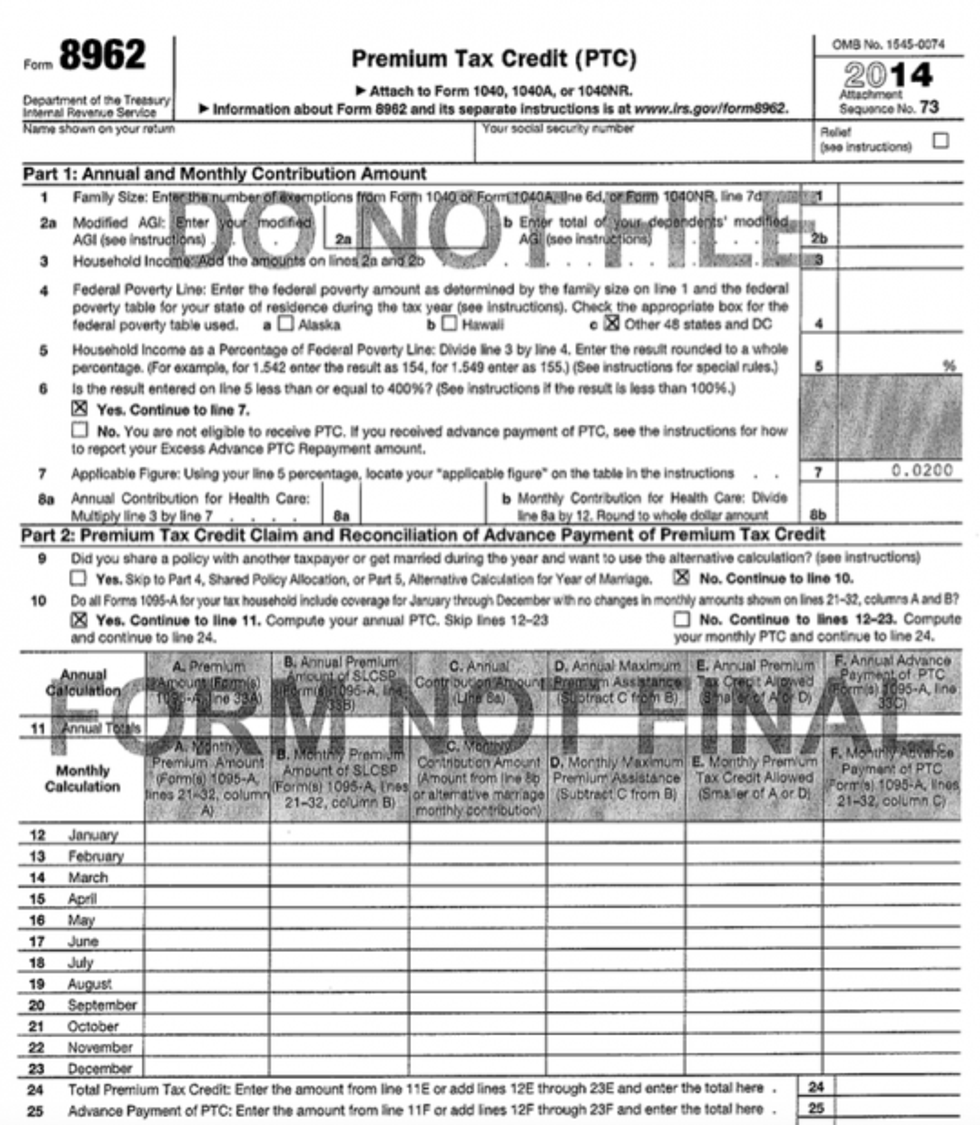

Anyone who needs to figure out their health insurance premium tax credit will have to navigate Form 8962. In its preliminary state, that form is two pages long, and helps people figure out exactly how much of a credit they get, based on their income and a sliding scale that reduces the credit the more people make.

It doesn't look all that complicated:

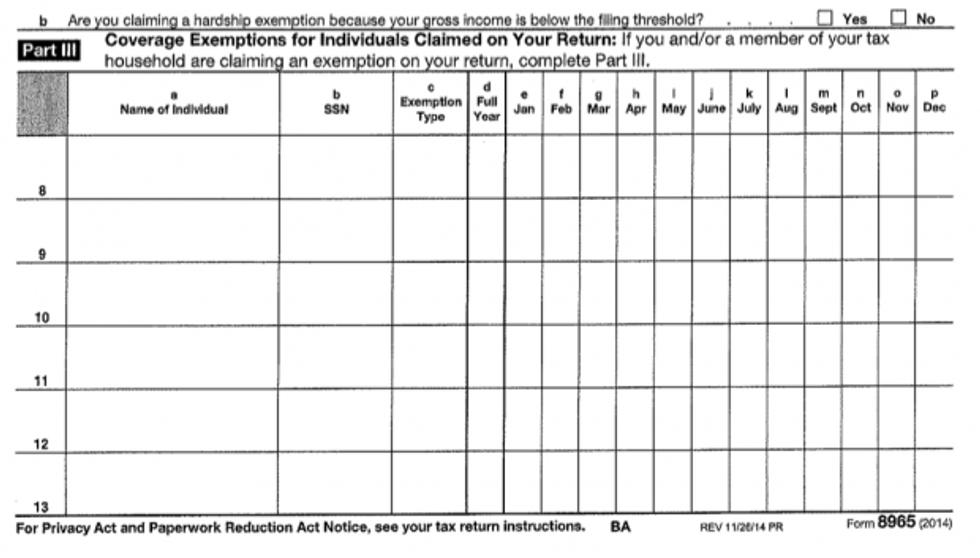

The third new form is Form 8965, which is for people who want to claim an exemption from Obamacare's health insurance mandate.

The IRS says that if you don't make enough money to file federal taxes, you are automatically exempt from Obamacare. "Taxpayers whose gross income is below their applicable minimum threshold for filing a federal income tax return are exempt from the individual shared responsibility provision and are not required to file a federal income tax return to claim the coverage exemption," the IRS said.

That's somewhat interesting because at the time, one of the major stated goals of Obamacare was to ensure that lower-income people were covered by health insurance. But because the IRS is implementing so much of the law, it appears that the IRS won't track people down who don't make enough money to file their taxes.

However, those who have to file but still think they are exempt can file Form 8965 and make their case to the IRS. More charts are involved:

Below are all the forms you'll need:

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2026 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.