© 2025 Blaze Media LLC. All rights reserved.

"The end of OPEC."

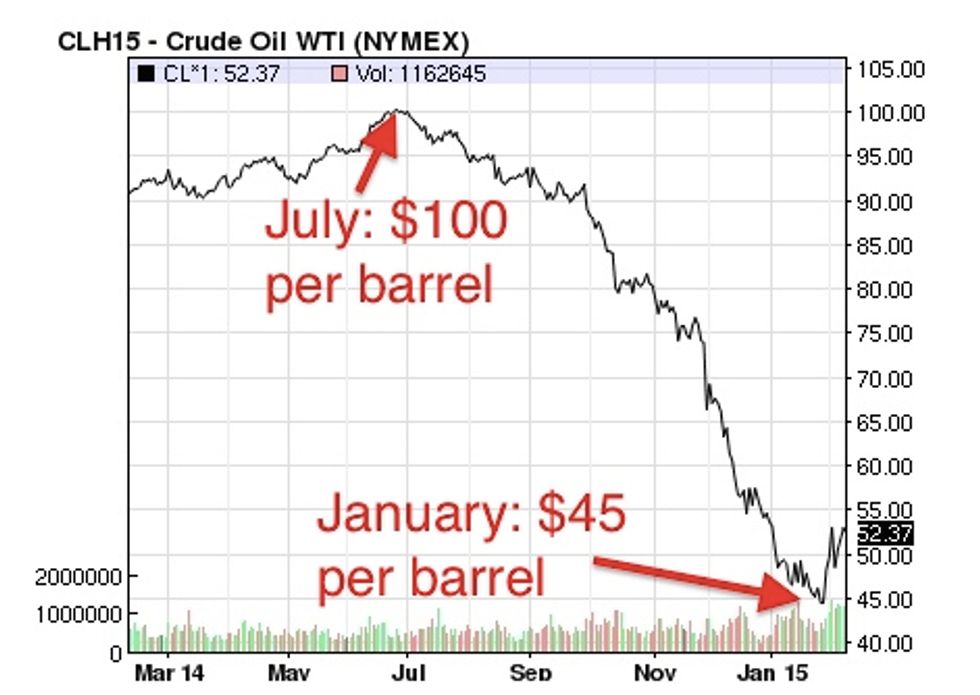

Enjoying cheap gas? Current low prices might just be the beginning — and it could mean the end of price-controlling OPEC.

Despite oil's already precipitous decline, Citigroup claims there's still plenty of room for the price to fall, Bloomberg reported Monday.

February's oil price surge is a "head-fake," said Edward Morse, Citigroup's global head of commodity research.

Pointing to rising U.S. production, record production from Russia and Brazil and the continued pumping in Iraq, Iran and Saudi Arabia, Morse said that oil could fall from current prices around $50 per barrel all the way down to $20 per barrel.

This on top of oil's decline from $100 per barrel last summer.

Many have predicted that falling prices could eventually gut the U.S. shale oil industry — many basins require oil prices above $75 per barrel to remain profitable — but analysts say American drillers have successfully hedged to remain viable in the short-term.

According to analysts like Morse, U.S. drillers seem to have successfully beaten OPEC, the old oil cartel that has for decades managed global oil prices.

"It looks exceedingly unlikely for OPEC to return to its old way of doing business," Morse wrote. "While many analysts have seen in past market crises 'the end of OPEC,' this time around might well be different."

—

Follow Zach Noble (@thezachnoble) on Twitter

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2025 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.