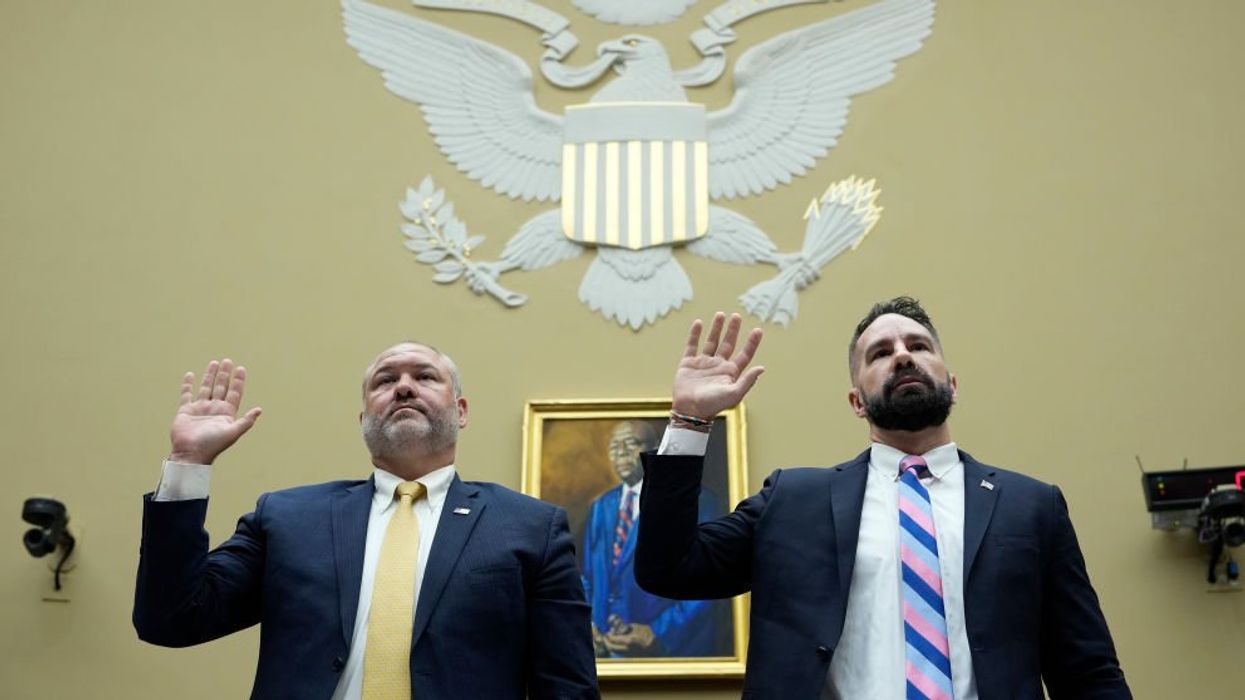

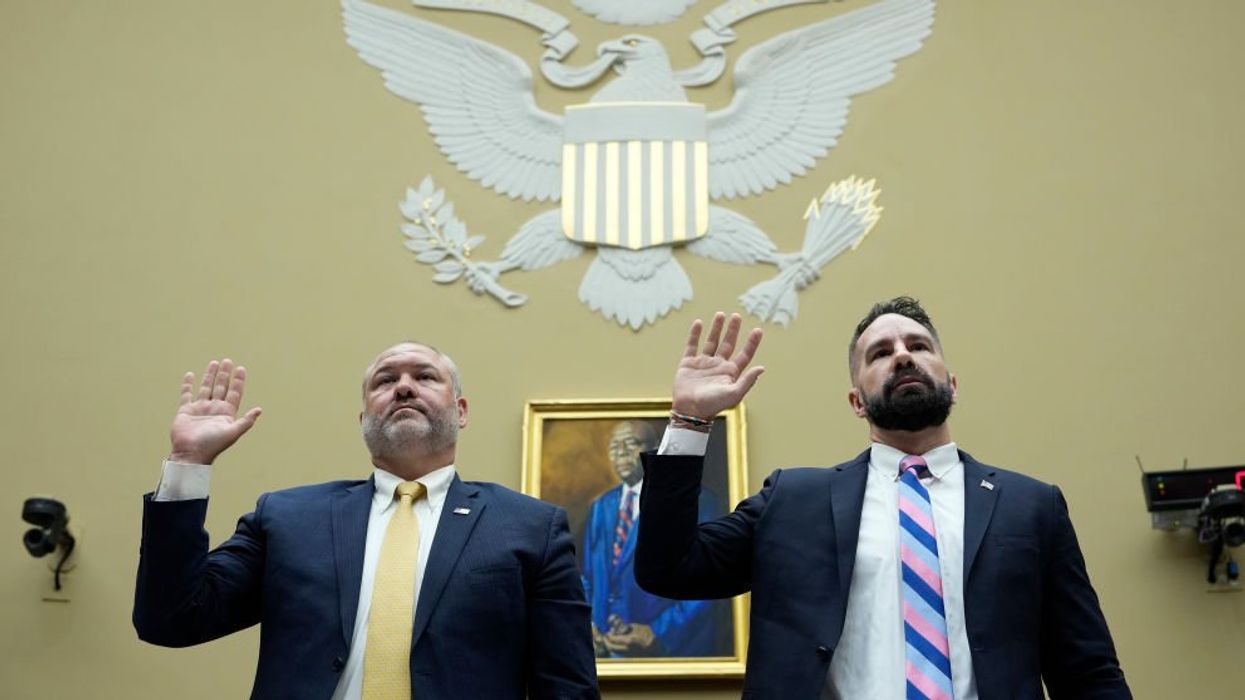

Drew Angerer/Getty Images

Hunter Biden sued the Internal Revenue Service on Monday, claiming that IRS whistleblowers have violated his privacy rights.

But attorneys for one of the whistleblowers say their client is fully protected by federal law.

The 27-page lawsuit accuses IRS whistleblowers Gary Shapley and Joseph Ziegler of unlawfully disclosing information about Hunter's tax information.

The IRS agents, the lawsuit claims, "have targeted and sought to embarrass Mr. Biden via public statements to the media in which they and their representatives disclosed confidential information about a private citizen’s tax matters."

"While Mr. Biden has been the victim of various leaks regarding the IRS investigation previously, most recently, two IRS agents—Mr. Gary Shapley and Mr. Joseph Ziegler—and their attorneys raised the stakes to unprecedented levels with their numerous public appearances and statements that blatantly violated Section 6103 of the Internal Revenue Code by engaging in a campaign to publicly smear Mr. Biden," the lawsuit states.

The lawsuit goes on to say:

This lawsuit is not about the proper workings of the whistleblower statute and process, nor an official using those procedures properly to make disclosures to authorized government officials. Rather, the lawsuit is about the decision by IRS employees, their representatives, and others to disregard their obligations and repeatedly and intentionally publicly disclose and disseminate Mr. Biden’s protected tax return information outside the exceptions for making disclosures in the law.

The lawsuit was filed in federal court. Importantly, the suit targets the IRS — not the whistleblowers themselves.

It's true that IRS employees are forbidden from disclosing taxpayer information. But, as the Wall Street Journal explained, there is a "crucial exemption."

"The chairs of the congressional tax-writing committees can request any taxpayer information from the IRS and then the committees can vote to make that information public in a report. The House Ways and Means Committee voted earlier this year to publish transcripts of interviews with the IRS employees in the Hunter Biden case," the newspaper explained.

The lawsuit, therefore, asserts the whistleblowers have disclosed information not released by Congress.

Specifically, the lawsuit alleges that Shapley unlawfully disclosed that Biden owed $2.2 million in unpaid taxes and that he allegedly expensed "prostitutes, sex club memberships, hotel rooms for purported drug dealers," among other details.

Lawyers for Shapley released a statement on Monday forcefully denying the allegations.

"Neither IRS SSA Gary Shapley nor his attorneys have ever released any confidential taxpayer information except through whistleblower disclosures authorized by statute. Once Congress released that testimony, like every American citizen, he has a right to discuss that public information," the attorneys asserted.

The lawsuit, Shapley's legal team claimed, is "just another frivolous smear by Biden family attorneys trying to turn people’s attention away from Hunter Biden’s own legal problems and intimidate any current and future whistleblowers."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!