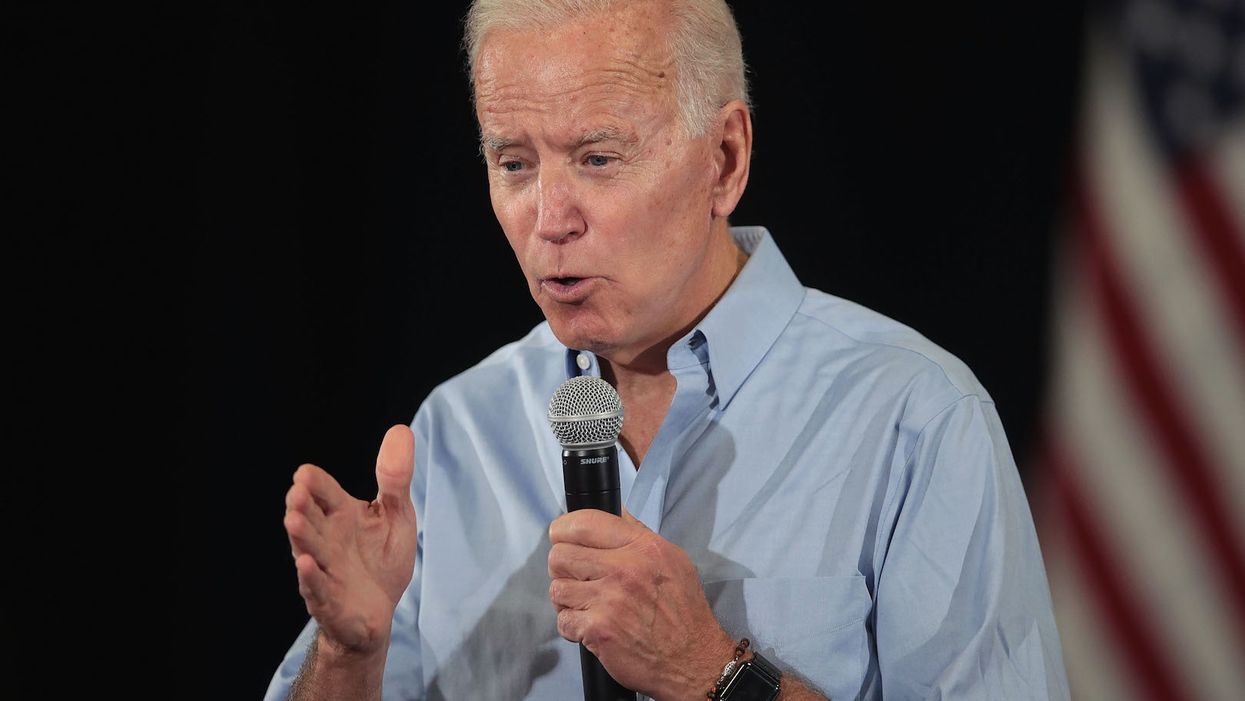

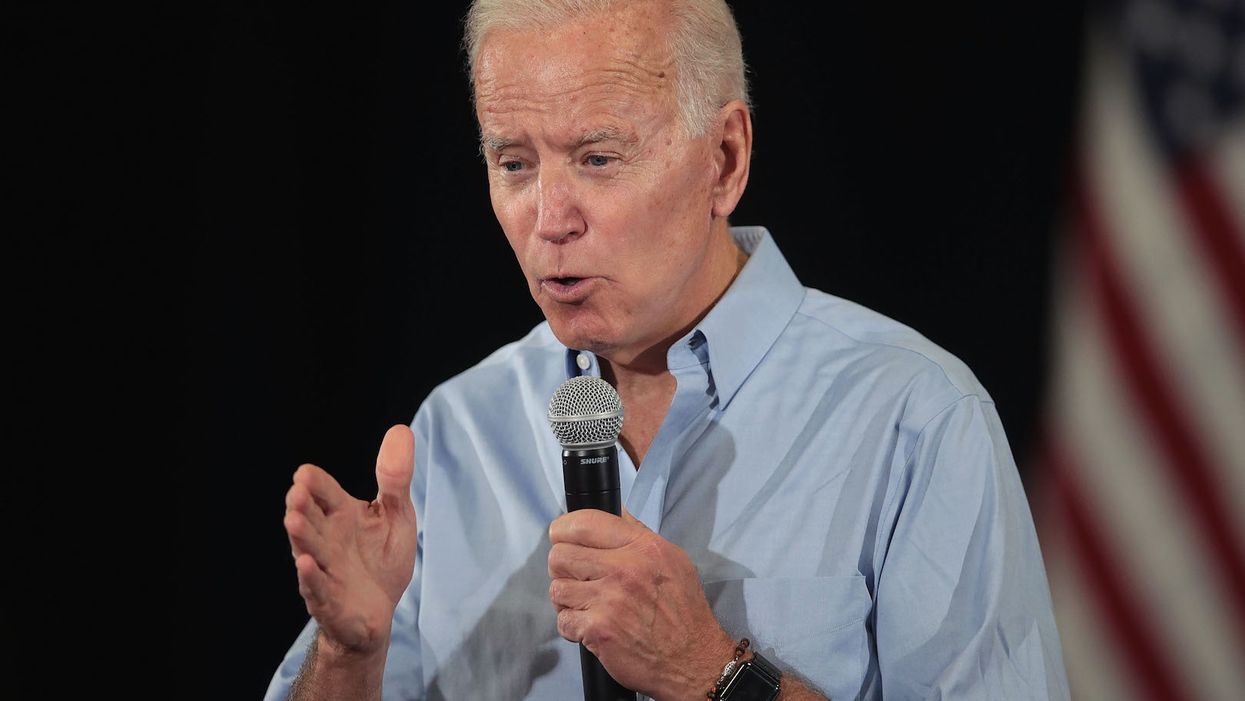

Scott Olson/Getty Images

He probably should've left them alone

Joe Biden's attempt to score some political points with a tweet about how little Amazon pays in taxes backfired Thursday when the company fired back with the facts to kill his narrative.

Biden tried to contrast the tax rate paid by Amazon with the tax rates paid by everyday workers.

"I have nothing against Amazon, but no company pulling in billions of dollars of profits should pay a lower tax rate than firefighters and teachers," Biden posted. "We need to reward work, not just wealth."

Whoever runs the Amazon News Twitter account did not appreciate being singled out in Biden's tweet, and felt led to correct the record.

"We've paid $2.6B in corporate taxes since 2016. We pay every penny we owe," read a tweet by Amazon News. "Congress designed tax laws to encourage companies to reinvest in the American economy. We have. $200B in investments since 2011 & 300K US jobs. Assume VP Biden's complaint is w/ the tax code, not Amazon."

Biden's original comment was in response to a New York Times article titled "Profitable Giants Like Amazon Pay $0 in Corporate Taxes. Some Voters Are Sick of It."

The article paints Amazon as one of the primary tax-avoiding Fortune 500 companies, and points to President Donald Trump's tax reform law as a big reason why that's possible. From the Times:

It's a topic that several presidential candidates, led by Senators Bernie Sanders and Elizabeth Warren, have hammered recently as they travel the campaign trail, spurred by a report that 60 Fortune 500 companies paid no federal taxes on $79 billion in corporate income last year. Amazon, which is reported to be opening a center in an abandoned Akron mall that will employ 500 people, has become the poster child for corporate tax avoidance; last year it had an effective tax rate of below zero — receiving a rebate — on income of $10.8 billion.

For decades, profitable companies have been able to avoid corporate taxes. But the list of those paying zero roughly doubled last year as a result of provisions in President Trump's 2017 tax bill that expanded corporate tax breaks and reduced the tax rate on corporate income.