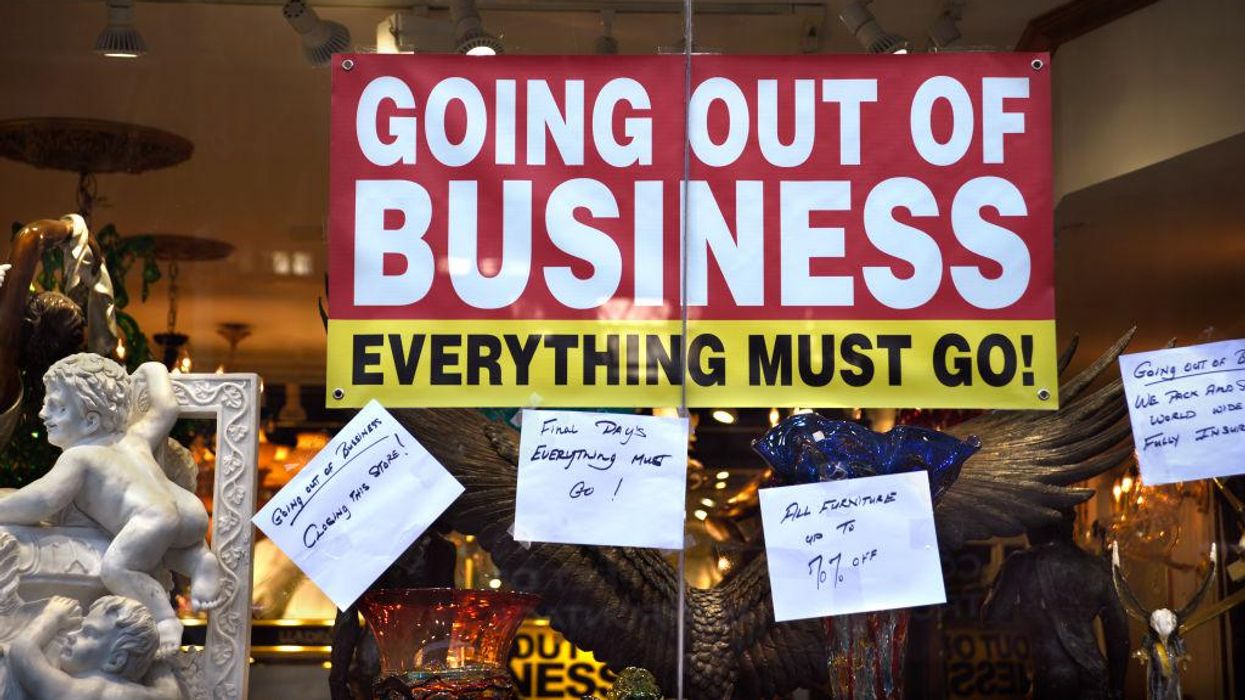

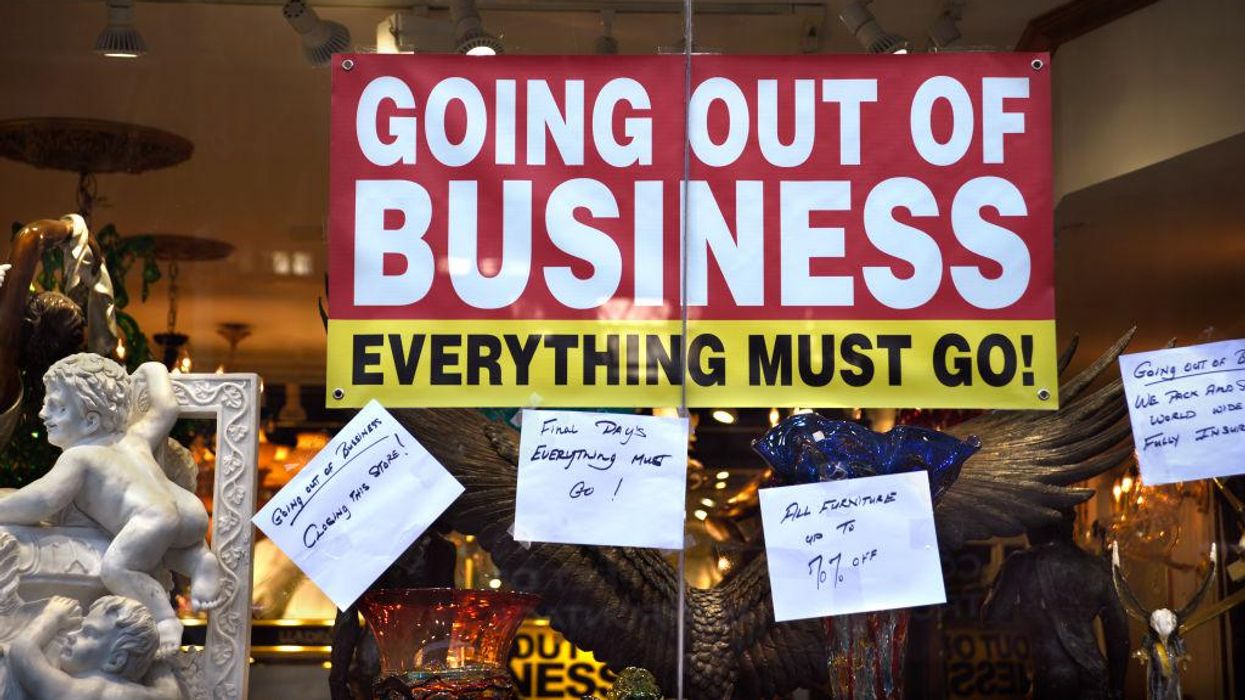

Robert Alexander/Getty Images

The U.S. economy has contracted for a second straight quarter – which signals that the country is in a technical recession.

The real gross domestic product (GDP) – the inflation-adjusted value of goods and services for sale produced by an economy – decreased by 0.9% in the second quarter of 2022, the Bureau of Economic Analysis (BEA) announced on Thursday morning. The Dow Jones had previously estimated a gain of 0.3% growth in the second quarter – which is the period between April 1 and June 30.

"The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE)," the BEA reported.

Financial experts utilize real GDP because gains brought on by inflation are not an economic benefit.

The economy shrank 1.6% in the first quarter. Two consecutive quarters of contraction of gross domestic product are typically considered a recession.

Investopedia defines a recession as a "significant, widespread, and prolonged downturn in economic activity. Because recessions often last six months or more, one popular rule of thumb is that two consecutive quarters of decline in a country's Gross Domestic Product (GDP) constitute a recession."

The definition of a recession as having two quarters of contracting GDP originated with economist Julius Shiskin. He popularized the rule of two consecutive quarters of economic decline as a sign of a recession in a New York Times article published in December 1974.

However, the Biden administration already planted the seeds of not acknowledging two consecutive quarters of economic downturn as a "recession."

Last week, the White House Council for Economic Advisers published a blog post arguing against the textbook definition of a recession.

"While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle," the Biden administration claimed. "Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data – including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year – even if followed by another GDP decline in the second quarter – indicates a recession."

The White House Council of Economic Advisers cited a definition of a "recession" given by the National Bureau of Economic Research (NBER): "A significant decline in economic activity that is spread across the economy and that lasts more than a few months."

Federal Reserve Chairman Jerome Powell said on Wednesday, "I do not think the U.S. is currently in a recession and the reason is, there's just too many areas of the economy that are performing too well."

Treasury Secretary Janet Yellen admitted on Sunday, "A common definition of recession is two negative quarters of GDP growth."

However, Yellen attested, "What a recession really means is a broad-based contraction in the economy. And even if that number is negative, we are not in a recession now. And I would, you know, warn that we should be not, not characterizing that as a recession.”

Wells Fargo senior economist Tim Quinlan doesn't believe the United States is currently in a recession, but cautioned that "it is starting to feel like [entering one] is only a matter of time."

"We do not think the economy is in recession at present, but if our forecast is correct, this is not so much of a head-fake as it is a harbinger of worse to come," Quinlan told Fortune. "We expect the loud wailing of an actual recession to begin early next year,."

Fortune reported last month, "The S&P 500 now implies an 85% chance of a US recession amid fears of a policy error by the Fed, according to JPMorgan Chase & Co."

A Financial Times poll released last month found that 68% of economists believe that the NBER will declare a recession in 2023.

BofA Securities economists predict a 40% chance of a recession within the next year.

In June, Goldman Sachs economists forecast a 30% chance of a recession over the next 12 months.

The GDP report was released one day after the Federal Reserve hiked interest rates by three-quarters of a percentage point for the second consecutive month in an effort to cool down record inflation and steer away from a recession. Inflation soared to 9.1% in June – the highest in 40 years.