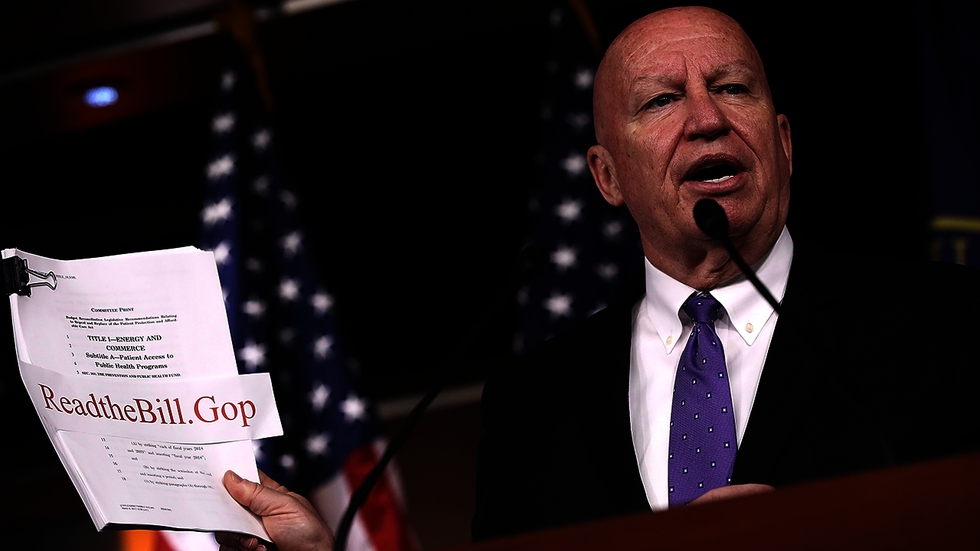

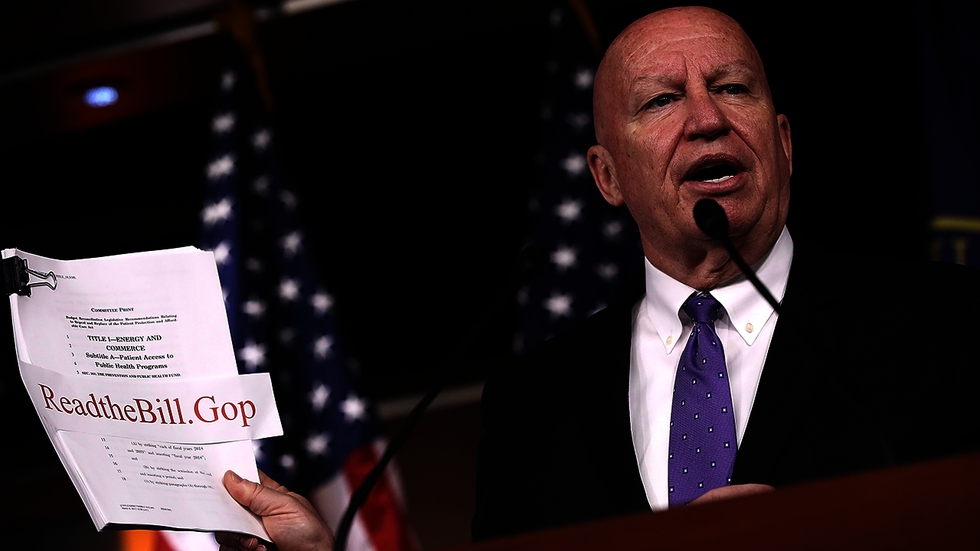

Win McNamee / Getty Images

It has been 31 years since Congress and the president worked together to reform the unfair and massive United States tax code. President Trump has made tax reform a critical priority for his administration with a goal of creating a simpler and lower tax rate for individuals and corporations. This goal will only be achieved through the hard work of Congressman Kevin Brady (R-Texas).

Mr. Brady is the Chairman of the House Ways and Means Committee, the powerful tax-writing committee that will shape, write, and control nearly every aspect of upcoming congressional tax proposals. Like a guide leading an expedition through the wilderness, Brady will help Washington navigate the hazards that typically arise when politicians finally attempt to take a hack at the massive, outdated tax code.

This will by no means be an easy task. The travails that came from creating the last tax reform measure in 1986 were detailed in the book, “Showdown at Gucci Gulch.” The book gave readers a behind the scenes look at the complicated interplay between the White House, Congress, lobbyists, and other special interest groups -- all of whom have a stake in the process.

Politicians love to talk about eliminating deductions and loopholes, but ”Showdown at Gucci Gulch” demonstrated how difficult it really is to turn that soundbite into legislative action. When politicians announced they would eliminate tax deductions, the first group to come forward in protest was the disabled veterans, who fought vigorously to protect their deduction. Multiply this isolated campaign by a thousand, and you will understand just how much pressure will be put on members of Congress during this arduous process.

Brady is going to face some difficult decisions. He has pledged to bring about a “simpler, fairer tax code that protects taxpayers, not special interests -- and helps America compete and win.” To accomplish that goal, he will need to take on everyone from the president, members of Congress, and the hordes of lobbyists that are gearing up for a fight. He’ll persevere only if he remains focused on the only people who truly matter -- the hard-working people of the United States.

Brady recently released his proposal called a “Better Way Forward on Tax Reform.” It is an outline that “delivers a 21st century tax code built for growth -- the growth of families’ paychecks, the growth of American businesses, and the growth of our nation’s economy.” Thankfully, it seems clear that Brady’s plan will avoid some of the “pay-for gimmicks” that were used by his predecessors.

In Washington parlance, a “pay for” is essentially a tax increase to “pay for” a tax cut or other loss of revenue. In many ways, “pay-fors” are a Beltway version of robbing Peter to pay Paul. An example included in a previous version of tax reform was called “accrual accounting.” Congress proposed taxing accounts receivables rather than income to make reform more palatable to the Congressional Budget Office (CBO). Brady has laudably junked this disaster of a provision.

In addition to “pay-fors,” there are major issues such as “carried interest” and “border adjustability” that Congress must navigate. Liberal Democrats like Sen. Chuck Schumer (D-NY) have suggested changing capital gains tax laws for investment partnerships. Rather than simplifying the code, the Schumer proposal will make things more complicated. Liberals’ hidden agenda in their attacks on carried interest is increasing taxes on capital gains from our investments. Brady knows this and has expressed opposition.

While Brady will undoubtedly face pressure from the White House and his colleagues in Congress, perhaps the most force will come from an onslaught of lobbyists representing some of the largest corporations in the world, many of which have moved jobs and facilities abroad. “Border adjustability” is just one provision that they oppose. Yet, Brady agrees with our president, acknowledging that “our tax code is pushing jobs overseas.” Now he will be challenged to walk the walk, taking on Walmart and some of the world’s biggest companies in the process.

To see more from Chris, visit his channel on TheBlaze and listen live to “The Chris Salcedo Show” weekdays 2–5 p.m. ET, only on TheBlaze Radio Network.

Chris Salcedo