© 2026 Blaze Media LLC. All rights reserved.

Sponsored by GSI Exchange

The following content was created and paid for by one of our advertisers. Our writers at Blaze News had no role in the creation of this post.

Most depositors are not aware that in the event of a banking collapse, banks are legally authorized to seize 50% or more of depositors' funds under the Dodd-Frank Title II - Orderly Liquidation Authority (OLA).

In the event of a financial crisis, this Dodd-Frank law allows banks to recategorize bank depositors as “unsecured creditors," giving banks the capacity to use depositor (now “creditor") funds as the bank's funds to avoid insolvency.

It's essentially a bank “bail-in," as opposed to a taxpayer “bail-out."

This critical piece of the Dodd-Frank law is conveniently buried within every depositor agreement, which depositors are expected to read, understand, sign, or simply accept. Once the agreement has been disclosed, it's a binding contract.

The problem, however, is twofold:

- Critical parts of the agreement--such as this one--are often buried within the document--hence, hard to find.

- If you find information that “discloses" this particular risk, it's often stated in legalese, making it difficult for the average reader to understand it.

This is deceptively plain and simple because it states risks in a way that cannot be easily found nor understood. Yet, all depositors end up bound to this agreement when they open a bank account.

Banks Have Amended Confiscation Terms in the Event of a Bank Failure

From June to November, possibly in response to the pandemic's effect on the global economy, Bank of America, Chase Bank, Citibank, and US Bank amended the terms that affect third-party bank accounts.

A third-party account is a bank account managed by any individual or company--an agent, nominee, guardian, executor, or custodian--on behalf of the owner. The new changes are the same across the board.

BUT HERE'S THE PROBLEM: Based on the existing FDIC form, most depositors don't know that they may already be subject to this current regulation.

What are we talking about, exactly? Read the following.

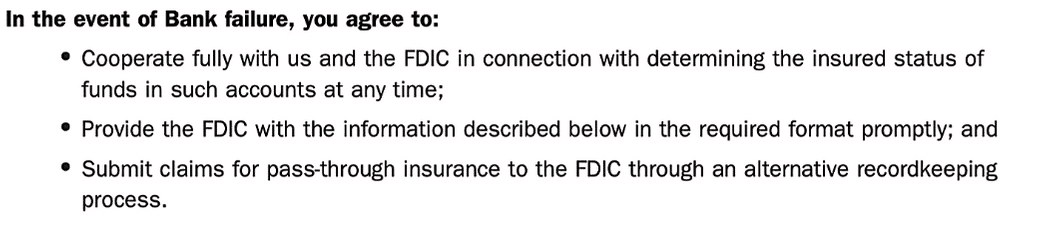

Bank of America's Deposit Agreement

Page 9:

Note that most banks require you to respond within 24 hours, yet Bank of America fails to disclose this potentially critical requirement--substituting the vague term “promptly" instead. Plus, you are expected to have read and understood three bullet points from a document with a total word count of over 20,000!

Note that most banks require you to respond within 24 hours, yet Bank of America fails to disclose this potentially critical requirement--substituting the vague term “promptly" instead. Plus, you are expected to have read and understood three bullet points from a document with a total word count of over 20,000!

Chase Bank's DEPOSIT ACCOUNT AGREEMENT AND PRIVACY NOTICE

Page 23:

“In the event of a bank failure, you agree to provide the FDIC with the information described above in the required format within 24 hours of a bank failure...You understand and agree that your failure to provide the necessary data to the FDIC may result in a delay in receipt of insured funds."

You are expected to have read and understood two sentences (54 words) from a document with a total word count of 25,121!

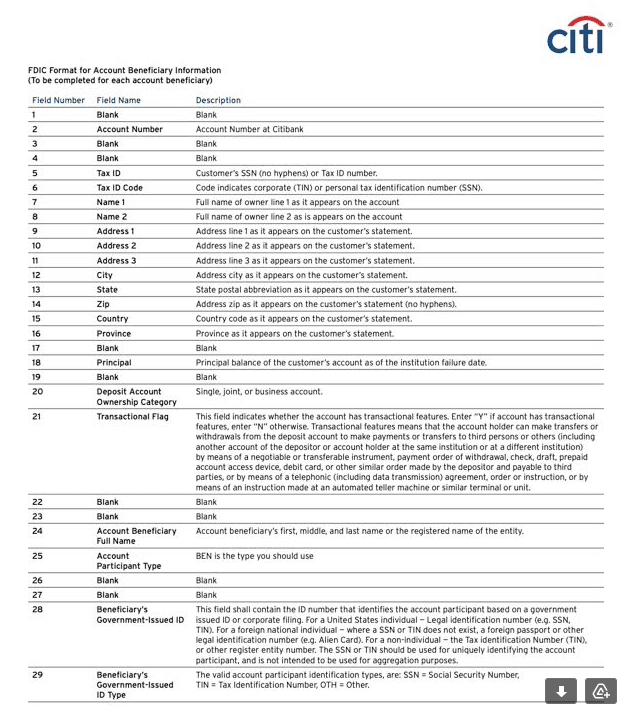

Citibank's Marketplace Addendum

Page 1:

“In the event that Citibank fails, you agree to cooperate fully with us and the FDIC in connection with determining the insured status of funds in such accounts. This includes providing the FDIC with the information described above in the required format within 24 hours of bank failure. You understand and agree that your failure to provide the necessary data to the FDIC may result in a delay in your receipt of FDIC insured funds."

You are expected to have read and understood three sentences (75 words) from a document with a total word count of 24,018!

US Bank's Your Deposit Account Agreement

Page 16:

“You agree to cooperate fully with us and the FDIC in connection with determining the insured status of funds in such accounts at any time. In the event of failure of U.S. Bank, you agree to provide the FDIC with the information described above in the required format within 24 hours of the failure of U.S. Bank."

You are expected to have read and understood two sentences (59 words) from a document with a total word count of 35,385!

Does this Apply to Third-Party Accounts ONLY, or to ALL BENEFICIARIES?

To answer this question, simply take a look at the actual form to fill out. Here's Citibank's form:

Note the term “beneficiary." If you deposit funds in a bank, you are the beneficiary of your own account, are you not?

If all beneficiaries are required to submit account information to the FDIC within 24 hours in the event of a bank failure--does it mean that the bank or the FDIC will automatically do it for you, or are you responsible for submitting this information yourself?

If you are responsible for requesting your own money" and saving it from potential confiscation, where does it say in the agreement that either you're to follow this procedure or that the bank will automatically do it for you?

Try reading through 20,000 to 40,000 words to find it. You can't or you won't, because disclosures were written in a way that makes important information nearly impossible to find or understand!

Suppose you don't read your deposit agreement in its entirety. Would you feel safe giving the banks the benefit of the doubt if it meant risking your own funds?

This may sound alarming, but the language put forth by banks, and the FDIC is so unclear that it's hard not to view it under suspicion...thinking that, perhaps, the language and the disclosure itself might be hiding information in such a way that benefits the banks at your expense (literally!).

Which prompts us to ask an important question...

Is This Amendment an Inconspicuous Way for Banks to Own Your Money?

If a bank fails, then certainly, you've read all 20,000 or more words in the agreement to remember that you have exactly 24 hours to submit all of the required information (as specified by each bank) to the FDIC, or your funds will be frozen.

Banks have assumed that you've read the entire disclosure document--at least enough to know this critical responsibility. The onus is on you!

The Dodd-Frank Orderly Liquidation Authority law will kick in, and 50% or more of your funds will already be converted to the bank's funds. Congratulations--you are now an unsecured creditor (no longer a depositor).

And if you or your custodian misses that 24-hour mark, you will no longer have access to your own money. Plain and simple.

Is this hasty FDIC amendment a way for banks to seize and convert the rest of the money left over from the Orderly Liquidation Authority measures?

GSI Exchange is an A+-rated firm with the BBB, AAA-rated with the BCA, Forbes Finance Council listed, and Platinum Dun & Bradstreet verified. Call 866-336-6817 or visit us on the web at GSIExchange.com to get more information or set up an account to convert savings into gold or silver and rollover IRA or 401(k) into physical precious metal IRA accounts, tax-free and penalty-free.

Anthony Allen Anderson is Senior Partner of GSI Exchange, an industry-leading coin and precious metals company specializing in the wholesale and direct trading of precious metals bullion and coins and establishing physical gold and silver IRAs for clients.

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

gsi-exchange

GSI Exchange

gsi-exchange

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2026 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.