Huang Evan/Getty Images

March’s CPI reading is out, with headline inflation still recording a substantial 5% year-over-year increase. But the media and elite are at it again. The same folks who said that there will be no inflation, it is transitory, it’s good for you, it only hurts the rich, it’s consumers’ fault, it’s greedy businesses’ fault, it’s Putin’s fault, and that you should maybe try eating lentils are now perplexed that you aren’t thankful for what is still a very high inflation level.

Yes, a recent headline pondered “Inflation is falling. Why aren’t people noticing?” It sounds very “let them eat cake” or, rather, let them eat a cake that is 20% smaller than the cake they ate a couple years ago, but with a 15% price increase.

Why aren’t you excited about this, the media asks?

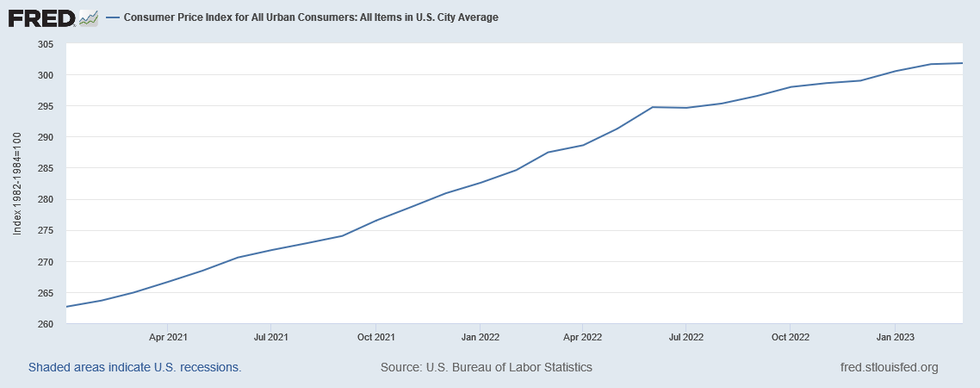

While the headline growth is coming down, inflation’s impact is cumulative and significant. Below is an indexed graph of CPI inflation since January 2021, the month that Biden took office. Cumulative costs have risen by double digits since 2021 started, and wages haven’t kept pace. That doesn’t seem like much to celebrate.

While people are suffering with the decline in purchasing power and racking up more debt, the people who have caused and run cover for inflation over the past couple of years are predictably slapping themselves on the back for what a great job they are doing.

And while they ponder why you aren’t more thankful, accountability is nowhere in sight. There is no acknowledgment by the Federal Reserve of its role in creating massive wealth transfers from Main Street America to Wall Street or even the banking crisis. Officials certainly haven’t admitted that their destructive monetary policy over the past 15 or so years, including around nine years of zero-interest-rate policy and ballooning their balance sheet to $9 trillion, played a substantial role in the inflation Americans are bearing.

The government, including the Biden administration, isn’t being accountable either. The stimulus that stimulated the economy too much isn’t being evaluated or apologized for.

Moreover, the government and the Biden administration aren’t helping the quest to curtail inflation at all. The CBO reported that the U.S. government deficit for the first half of fiscal year 2023 was a whopping $1.1 trillion, $430 billion more than the same time last year.

Officials refuse to take action on the supply side, too. They won’t reverse course on their dangerous energy policy or enact any other policies that remove the barriers they have created in other key markets, such as labor and housing.

While they destroy your wealth, they wonder why you haven’t busted out the champagne and caviar. They wonder, but they don’t care, and they won’t do anything to take accountability to stop it from happening again. Don’t let them forget it was their fault.

Carol Roth's new book, “You Will Own Nothing,” is available for pre-order now.Carol Roth

Contributor