© 2025 Blaze Media LLC. All rights reserved.

Morning Market Roundup: Jobless Claims Drop 35K, Govt & Healthcare Fraud, Exxon Profit Boost

July 26, 2012

Here’s what’s important in the business world this morning:

Jobless Claims: The number of Americans applying for unemployment benefits dropped by 35,000 last week, a figure that may have been distorted by seasonal factors.

The Labor Department said Thursday that applications fell to a seasonally adjusted 353,000. That's down from a revised 388,000 the previous week and the biggest drop since February 2010.

The four-week average, a less volatile measure, declined 8,750 to 367,250. That's the lowest level since the end of March.

Applications surged two weeks ago, reversing a big drop the previous week. But economists caution that the government struggles every July to account for temporary summer shutdowns in the auto industry. The adjustments have been unusually difficult this year because some automakers skipped their shutdowns in the face of stronger sales, resulting in fewer temporary layoffs.

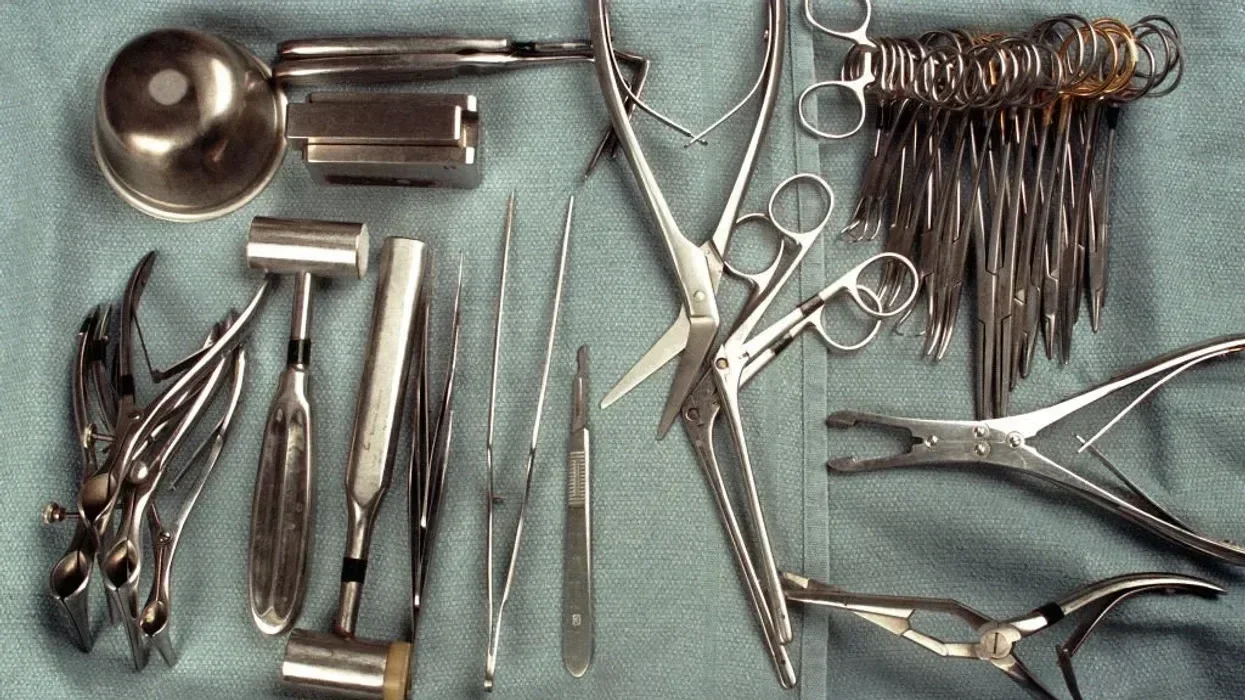

Healthcare Fraud: The government is stepping up efforts to tackle health care fraud by scrutinizing claims data from insurers and federal programs in hopes of weeding out bogus billing.

Details of the initiative were to be announced Thursday at the White House by Health and Human Services Secretary Kathleen Sebelius, Attorney General Eric Holder, and insurance executives.

The analysis of data from Medicare, Medicaid and private health plans will look for suspicious patterns and other evidence that might indicate fraud, White House officials said. A "trusted third party" would comb through the data and turn questionable billing over to insurers or federal investigators.

Among organizations expected to join the FBI in in the anti-fraud partnership are America's Health Insurance Plans and the Blue Cross and Blue Shield Association; both played a major role in the health care debate.

Officials said those who submit fraudulent claims often do so for both government programs and private insurance plans. Separately, such claims might not raise suspicions, but taken together they could raise a red flag, such as when a doctor bills for more than 24 hours in a day.

Exxon: Exxon Mobil said Thursday that net income rose 49 percent in the second quarter as it made $7.5 billion from selling company assets.

Those sales masked an otherwise tough quarter for America's largest oil company. Exxon produced less oil and natural gas from April to June, and it sold both at lower prices. Excluding asset sales, company profit fell by 21.5 percent to $8.4 billion. That's Exxon's smallest profit since the third quarter of 2010.

Shares fell 84 cents, or 1 percent, to $84.40 in premarket trading.

Quarterly revenue rose 1.5 percent to $127.4 billion.

U.S. Futures: U.S. stock futures jumped sharply Thursday after the president of the European Central Bank vowed to preserve the continent's monetary union.

The euro has tumbled against the dollar and investors have fled stocks with the debt crisis in Europe threatening to drag more nations there into recession. European companies have been hit particularly hard and their shares in the U.S. have taken a beating this week.

However, after comments from ECB President Mario Draghi, Dow Jones industrial futures rose 127 points to 12,764 and the broader S&P futures added 16.4 points at 1,351.50. Nasdaq futures tacked on 34.5 points at 2,578 despite more disappointing news from the technology sector.

Dow Jones futures, which had been down 40 points, reversed course almost immediately, as did other futures markets.

The Associated Press contributed to this report.

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2025 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.