(AP Photo/Susan Walsh).

(AP Photo/Susan Walsh).

WASHINGTON (AP) -- Chairman Ben Bernanke said Wednesday that the U.S. economy still needs help from the Federal Reserve's low interest rate policies.

Bernanke told the National Bureau of Economic Research that because unemployment remains high and inflation is below the Fed's target, the policies are still necessary. He also said the economy is being held back by higher taxes and federal spending cuts.

"If you put all of that together, you can only conclude that highly accommodative monetary policy for the foreseeable future is what is needed for the U.S. economy," Bernanke said.

However, Federal Reserve officials seem far from a consensus on the question of when to draw down the bond purchases.

Minutes of their June 18-19 policy meeting released Wednesday show many of the 19 officials felt the job market's gains would have to be sustained before the Fed would scale back its bond purchases, which have helped support spending and growth, lifted stocks and kept mortgage rates near record lows.

At the June policy meeting, many Fed officials thought the purchases should extend into 2014, according to a summary of economic forecasts that are released with the minutes. Still, several thought a slowdown in purchases could start soon.

The divisions revealed Wednesday reflect the difficulty investors have had deciphering the Fed's intentions.

Stock index futures rose as Bernanke spoke Wednesday. The Standard & Poor's index futures were up eight points, or 0.5 percent, at 1,656 as of 5:40 p.m. Eastern Daylight Time -- shortly after Bernanke wrapped up his remarks.

Bernanke's comments were his latest effort to stress that the Fed will continue to stimulate the economy, even after it begins to slow $85-billion-a-month in bond purchases that have kept long-term interest rates down.

The Fed plans to keep its investment holdings constant to avoid causing long-term rates to rise too quickly. It also plans to keep short-term rates at record lows at least until unemployment slides to 6.5 percent.

And Bernanke has said 6.5 percent unemployment is a threshold, not a trigger: The Fed might decide to keep its benchmark short-term rate near zero even after unemployment falls that low.

Unemployment is currently 7.6 percent.

On Wednesday, Bernanke didn't signal any changes in the bond-buying program. But Bernanke defended recent comments he made after the Fed's June meeting.

Some critics said the Fed bungled its communications strategy.

Bernanke asked his audience to consider what might have happened if the Fed had given no signals on when the bond buying might be curtailed. He said that might have led to an increase in risk-taking on the part of investors "reflecting an expectation for an infinite" program of bond purchases.

"Explaining what we are doing may have avoided a much more difficult situation at another time," he said.

Bernanke also did not provide any clues on his own future. Many expect he will leave when his current term ends in January.

When asked about his legacy, he said others would certainly judge his handling of the 2008 financial crisis. He also said the Fed, under his leadership, has made significant strides in providing the public with more information on how the central bank operates.

Markets are surging Thursday following Bernanke's Wednesday remarks:

Associated Press writer Tracee Herbaugh contributed to this report from Cambridge, Mass.

–

[related]

Follow Becket Adams (@BecketAdams) on Twitter

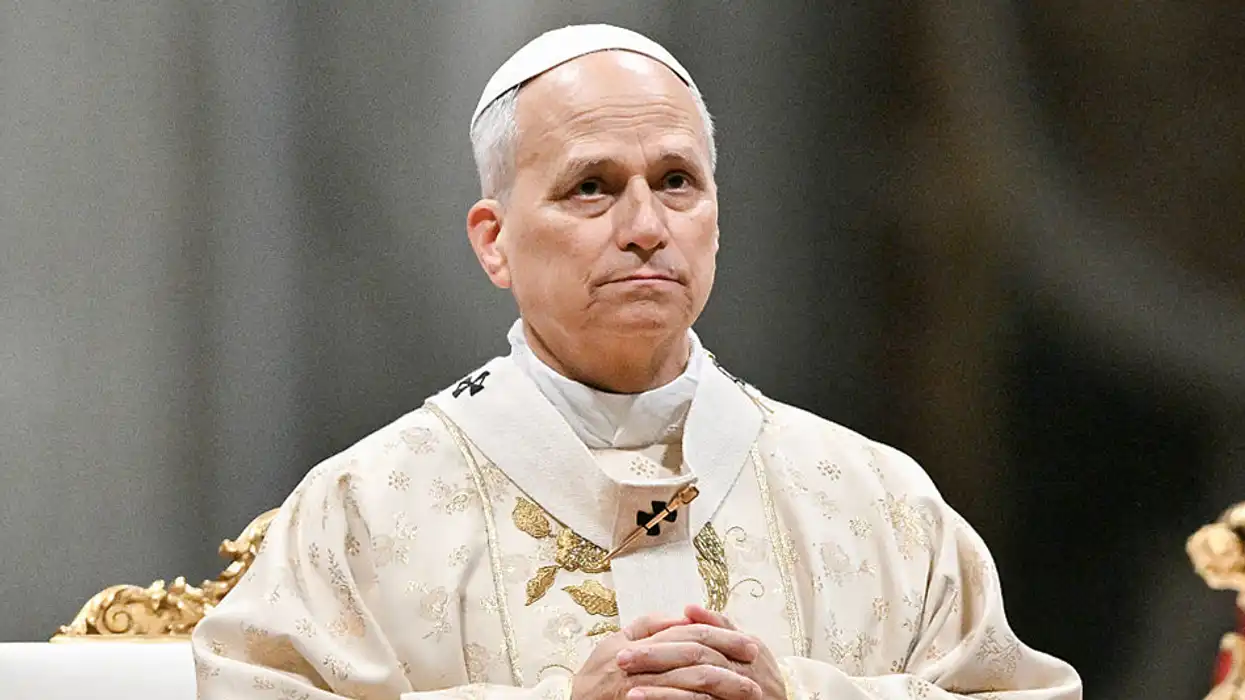

Featured image AP photo.

(AP Photo/Susan Walsh).

(AP Photo/Susan Walsh).