Amid continuing questions regarding the Internal Revenue Service's targeting of conservative groups, the agency is considering new rules that would curb what certain nonprofits can say about presidential nominees and scores of other government appointees.

The IRS issued proposed rules last month to crack down on tax-exempt 501(c)(3) organizations that under the law may be involved in politics but must primarily be social welfare organizations.

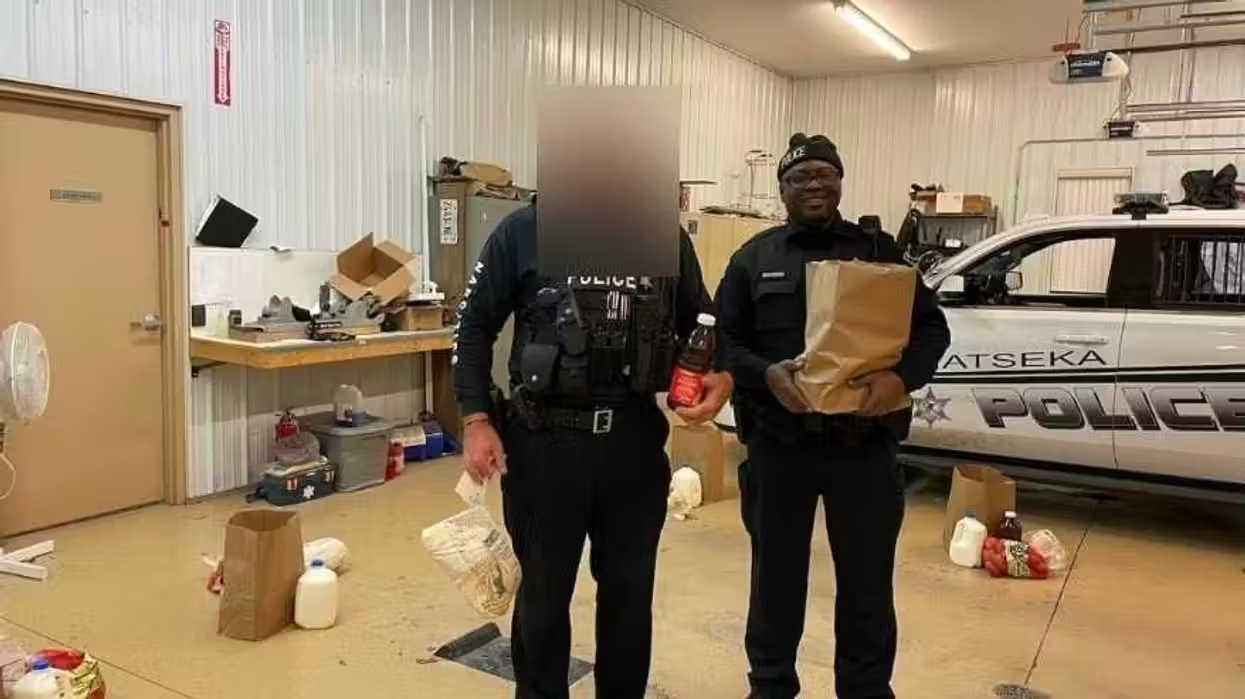

AP

AP

What didn't get as much attention is that the rule expands candidate-related activity beyond the typical notion of candidates seeking elected office.

The regulations define “candidate” as “an individual who identifies himself or is proposed by another for selection, nomination, election, or appointment to any public office or office in a political organization, or to be a Presidential or Vice-Presidential elector, whether or not the individual is ultimately selected, nominated, elected, or appointed.”

“The Treasury Department and the IRS note that defining ‘candidate-related political activity’ in these proposed regulations to include activities related to candidates for a broader range of offices (such as activities relating to the appointment or confirmation of executive branch officials and judicial nominees) is a change from the historical application in the section 501(c)(4) context of the section 501(c)(3) standard of political campaign intervention, which focuses on candidates for elective public office only," the proposal states.

The rule is open for public comment until fall 2014 before it can be implemented. The tax collection agency's proposal comes in the middle of investigations into the IRS targeting of conservative and Tea Party organizations. Other aspects of the proposed IRS rules would prohibit certain non-profit groups from backing candidates, making political pronouncements 60 days before an election and participating in get-out-the-vote drives.

“These proposed regulations would replace the language in the existing final regulation under section 501(c)(4)—‘participation or intervention in political campaigns on behalf of or in opposition to any candidate for public office’—with a new term—‘candidate-related political activity’—to differentiate the proposed section 501(c)(4) rule from the standard employed under section 501(c)(3) (and currently employed under section 501(c)(4))," the proposal states. "The proposed rule is intended to help organizations and the IRS more readily identify activities that constitute candidate-related political activity and, therefore, do not promote social welfare within the meaning of section 501(c)(4).”

The IRS declined to comment on the record about the matter.

If adopted, such a rules change would be open to broad legal interpretation, said Hans Bader, senior attorney for the Competitive Enterprise Institute, a free market think tank.

“Their new definition of candidate-related activity is counter-intuitive and Orwellian,” Bader told TheBlaze. “This is not just for executive and judicial nominees. This would technically include every appointee to a military commission. There are an awful lot of appointed positions in government, thousands and thousands.”

The proposed rule doesn't specify presidential appointees subject to Senate confirmation. Thus it could include everything from the White House chief of staff to a federal official working at a regional Agriculture Department extension office as shielded from criticism or praised by a 501(c)(4) group.

“This is a First Amendment violation,” Bader said.

The IRS has also said it could expand similar rules to to 501(c)(3) groups, such as CEI and other think tanks and nonprofit groups that are forbidden under their tax exempt status from endorsing candidates, but have traditionally weighed in on Supreme Court nominations, cabinet secretary nominations and other executive and judicial nominees that would be classified as “candidates” under the new rule.

“Thus, think tanks, which have have historically been allowed to criticize executive and judicial nominees for their misconduct or bad policies, could be banned from doing so, simply by the IRS radically redefining the candidate-related partisan political activity they are already forbidden to engage in (electioneering) to include non-partisan criticism that has nothing to do with election campaigns or electioneering,” Bader wrote in a post on the OpenMarket.org blog.

–

[related]

AP

AP