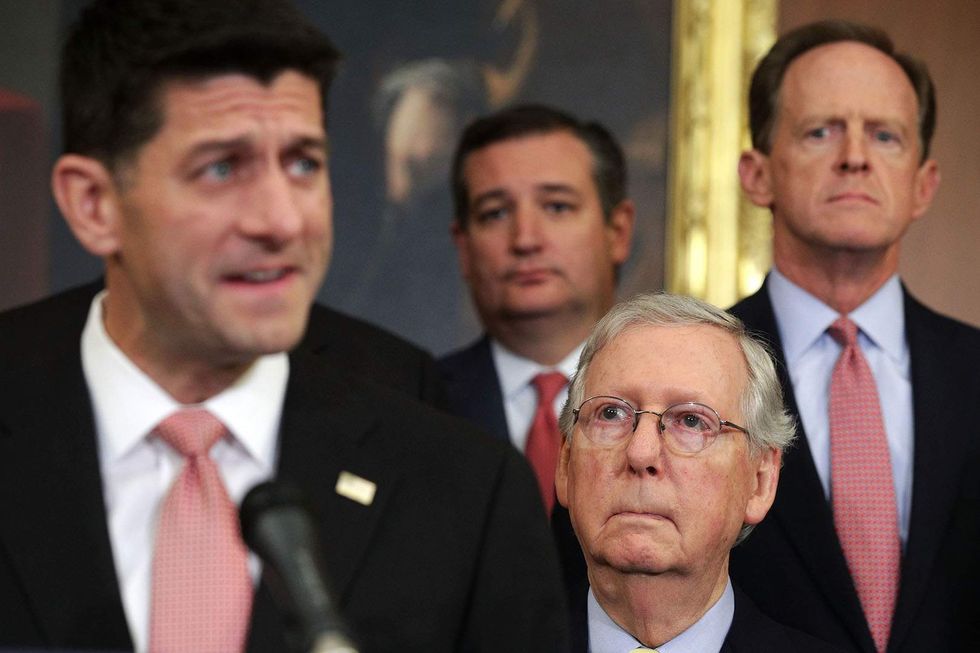

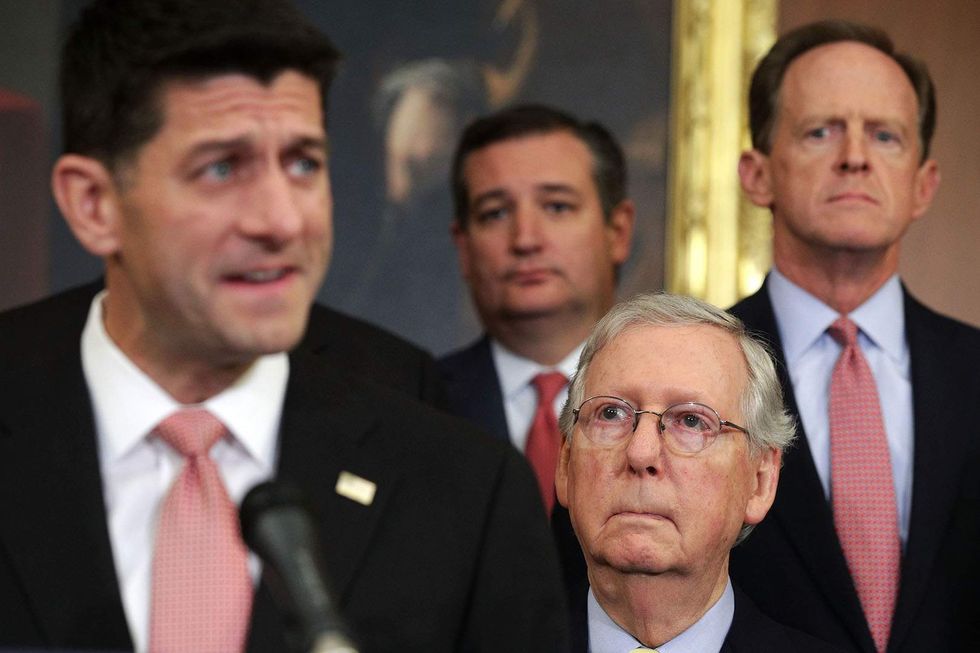

Senate Majority Leader Mitch McConnell and House Speaker Paul Ryan conceded that some middle class taxpayers might see a tax increase under the proposed Republican plan. (Alex Wong/Getty Images)

Mitch McConnell and Paul Ryan want you to know they didn't really mean that everyone would get a tax cut under the Republicans' proposed tax reform plan, and now both the Senate Majority Leader and the Speaker of the House have clarified their previous statements.

What McConnell originally said: "Nobody in the middle class is going to get a tax increase," he said on MSNBC last week.

What he said later: "You can't guarantee that absolutely no one sees a tax increase," he clarified to the New York Times on Friday, saying that every income group, on average, would see a tax cut.

Ryan was faced with the necessity of issuing that same correction earlier this week.

What Ryan originally said: "So actually, even though there's a lot of false information out there, everybody gets a tax cut," he said Wednesday.

What he said later: "At every income level, there is a tax cut for the average family," Ryan said Thursday. A spokeswoman for Ryan told The Washington Post that Ryan initially misspoke.

While middle class tax payers would see their tax rates either decrease or stay the same under the new plan, there are potentially millions of taxpayers who could actually end up paying more when all is said and done due to the elimination of many deductions.

For more information on the potential tax benefits for some taxpayers under the proposed plan, here are three economic reviews of the policy: