A Pennsylvania judge ruled this month that a widow was given enough notice of an unpaid bill amounting to all of $6.30 before her $280,000 house was sold at a tax auction in 2011.

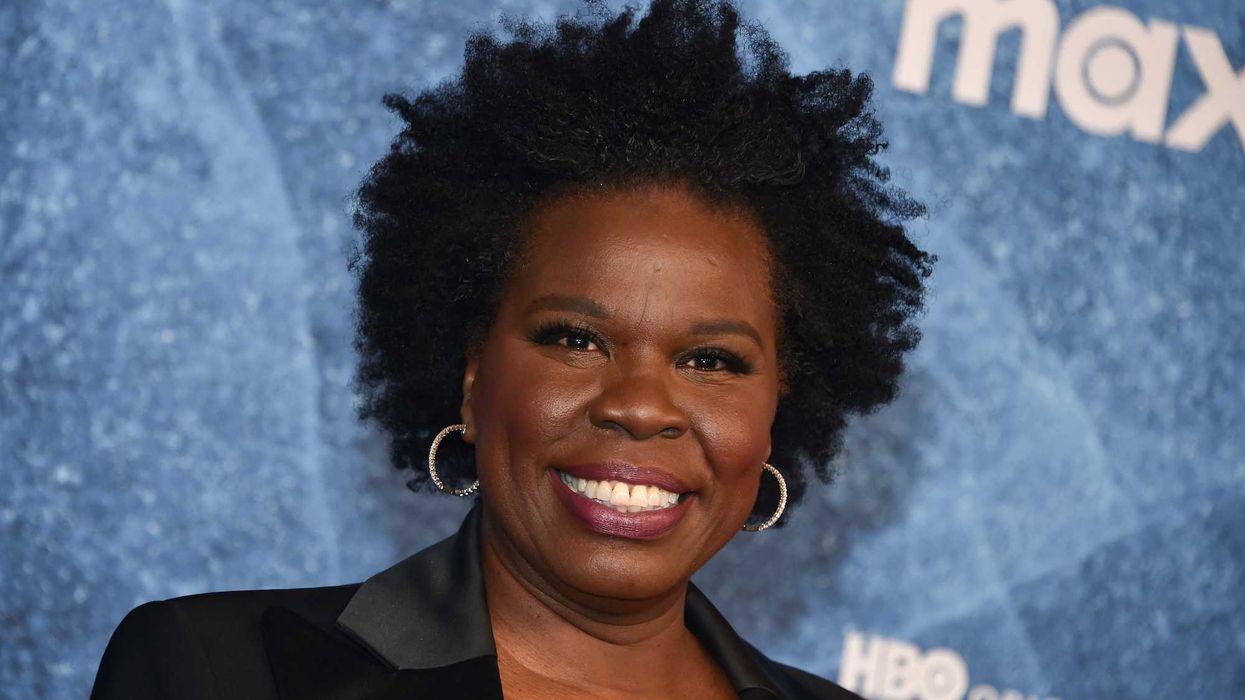

Eileen Battisti sits on the stairs in front of her home in Aliquippa, Pa. Beaver County Common Pleas Judge Gus Kwidis ruled April 22, 2014, to turn down Battisti's request to reverse the sale of her $280,000 house at a tax auction three years ago over $6.30 in unpaid interest (AP)

Eileen Battisti sits on the stairs in front of her home in Aliquippa, Pa. Beaver County Common Pleas Judge Gus Kwidis ruled April 22, 2014, to turn down Battisti's request to reverse the sale of her $280,000 house at a tax auction three years ago over $6.30 in unpaid interest (AP)

Eileen Battisti, 53, maintains that she was unaware of the unpaid bill and has spent more than two years trying to overturn a court decision that saw her lose legal rights to her home near Aliquippa in western Pennsylvania.

"I paid everything, and didn't know about the $6.30," Battisti said. "For the house to be sold just because of $6.30 is crazy."

The widow has not yet moved out of the house and said she plans to appeal to Commonwealth Court, the Associated Press reported, after the court ruled last week that the auction of her house was valid.

The county tax claim bureau followed all proper notification procedures as dictated by state law before the house auction, Beaver County Common Pleas Judge Gus Kwidis wrote in his decision.

Kwidis said Battisti also owed approximately $235 in various interests and fees at the time of the 2011 tax auction.

The widow reportedly admitted to receiving some of those notices, the judge wrote, according to the Pittsburgh Tribune-Review.

"There is no doubt that (she) had actual receipt of the notification of the tax upset sale on July 7, 2011, and Aug. 16, 2011," Kwidis wrote. "Moreover, on Aug. 12, 2011, a notice of sale was sent by first class mail and was not returned."

If Battisti’s appeals fail in future hearings, she will get most of the proceeds from the sale of her home, which fetched only $116,000.

“She's going to get that money, but she's going to lose her house. All the notice requirements were met,” wrote Kwidis. “In tax assessment laws, even if I feel sorry for her, I can't do anything to help her.”

Beaver County's chief solicitor said he supports Kwidis’ decision.

"The county never wants to see anybody lose their home, but at the same time the tax sale law, the tax real estate law, doesn't give a whole lot of room for error, either," Joe Askar said.

The widow said her husband handled most of the estate’s legal paperwork before he passed away in 2004.

The home of Eileen Battisti is seen in her neighborhood in Aliquippa, Pa. (AP)

The home of Eileen Battisti is seen in her neighborhood in Aliquippa, Pa. (AP)

"It's bad — she had some hard times, I guess her husband kind of took care of a lot of that stuff," Askar said. "It seemed that she was having a hard time coping with the loss of her husband — that just made it set in a little more."

AP

AP

Battisti said she isn’t interested in collecting on the sale of the home and will continue to fight the 2011 decision.

The widow will be allowed to stay in her home until a final ruling is handed down.

—

Follow Becket Adams (@BecketAdams) on Twitter

Eileen Battisti sits on the stairs in front of her home in Aliquippa, Pa. Beaver County Common Pleas Judge Gus Kwidis ruled April 22, 2014, to turn down Battisti's request to reverse the sale of her $280,000 house at a tax auction three years ago over $6.30 in unpaid interest (AP)

Eileen Battisti sits on the stairs in front of her home in Aliquippa, Pa. Beaver County Common Pleas Judge Gus Kwidis ruled April 22, 2014, to turn down Battisti's request to reverse the sale of her $280,000 house at a tax auction three years ago over $6.30 in unpaid interest (AP)