Image source: AP

The Department of Veterans Affairs this week explained how it managed to spend hundreds of thousands of dollars to help a top official relocate to Philadelphia — and in doing so, it revealed what appears to be a scam that allows these officials to sell their homes at inflated prices, all thanks to taxpayers.

Congress has been after the VA for the last several weeks to explain how it spent more than $300,000 to move Diana Rubens from Washington, D.C., to Philadelphia, where she now runs the Philadelphia VA. This week, the VA sent a letter to House Veterans Affairs Committee Chairman Jeff Miller (R-Fla.) to explain how it all works.

The Department of Veterans Affairs appears to be subsidizing the sale of homes for senior officials who are asked to relocate, letting these workers sell their houses for above-market prices. Image: AP

The Department of Veterans Affairs appears to be subsidizing the sale of homes for senior officials who are asked to relocate, letting these workers sell their houses for above-market prices. Image: AP

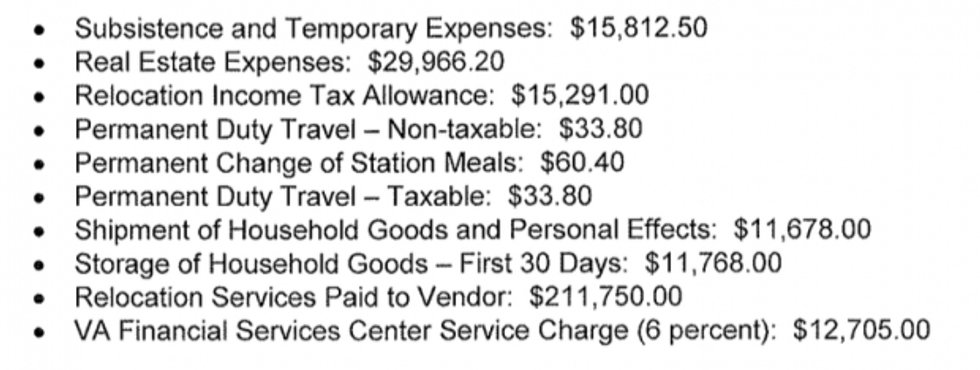

Among other things, that letter from VA Undersecretary for Benefits Allison Hickey said Rubens was paid more than $80,000 in expenses. Those expenses appear to include temporary living costs and tax and real estate expenses that non-government workers would have to pay themselves.

But the most intriguing part of the letter is the Appraised Value Offer (AVO) program, under which the VA itself shelled out another $211,000 to help Rubens move. The letter explained that by law, the VA is allowed to hire a relocation services company when it needs help sending a worker from one city to another.

Employees benefit from the program if they can't sell their homes within 60 days. At that point, the home can be sold to a relocation services company, and that's where it gets interesting.

In Rubens' case, the sale of her home to a contractor seems to have been at a marked up price, a tab taxpayers eventually picked up. It appears to have worked like this:

Rubens couldn't sell her home in Alexandria, Virginia after 60 days. Under the AVO program, she was able to sell her home to a relocation services company, Stone Financing LLC, which bought the house for $770,000 in July 2014.

According to property records, Stone Financing then sold the house for $692,500 in February 2015.

On the surface, it appears that Stone Financing took a loss of nearly $80,000 on the house. However, the VA's letter noted that under the AVO program, the VA gives the property services company 28 percent of the appraised value of the home.

For Rubens' house, that was $211,750. That means the VA essentially wrote a big check, using taxpayer money, to make sure Stone Financing would profit on the deal.

When the nearly $80,000 loss is balanced with the $211,000 gain, Stone Financing appears to have made about $134,000 off of the deal.

Taken as a whole, the transaction as described by the VA seems to indicate that Rubens was able to sell her home to Stone Financing for more than it was really worth, to her obvious benefit. Stone Financing didn't object to paying too much for the house, because it knew a check was coming from the government that would allow it to profit.

But Rubens could only sell her house for the inflated price — and make $80,000 more off the sale — because taxpayer money was going to make Stone Financing whole again.

The chairman of the House Veterans Affairs Committee, Rep. Jeff Miller (R-Fla.), indicated Tuesday that he also sees the transaction as a likely scam against taxpayers. "The federal government's Appraised Value Offer program is a scheme in which everyone but the taxpayer wins," he said in a statement provided to TheBlaze.

Miller also threatened to shut it down if the VA doesn't stop treating it like an entitlement.

"AVO may have been conceived as an incentive, but at VA it’s become an entitlement, in which taxpayers are forced to subsidize the real estate choices of already generously compensated VA executives," he said. "As such, I am calling on VA leaders to put forth a plan to end the department's use of the program."

"If no plan is forthcoming, we'll explore legislative remedies to do the same," he added.

The VA's letter also explained that under the law, officials are entitled to a range of expenses when they're asked to relocate to another city. These even include "house hunting" visits to their new city that can last up to 10 days.

Read the full VA letter here: