Neil Rasmus/Patrick McMullan via Getty / Mike Kemp/In Pictures via Getty Images

Trump’s new law forces full Epstein files by Dec. 19, but Glenn Beck says the real scandal is the bank that spent years looking away from $1.3 billion in red flags.

Jeffrey Epstein’s name is yet again dominating headlines as the American people await a third major handover of Epstein-related documents. President Trump signed the Epstein Files Transparency Act into law, mandating the Department of Justice’s public release of all unclassified files related to Jeffrey Epstein and Ghislaine Maxwell. Once again, everyone’s holding their breath for the flight logs, communications, and investigative records slated for release on December 19, 2025.

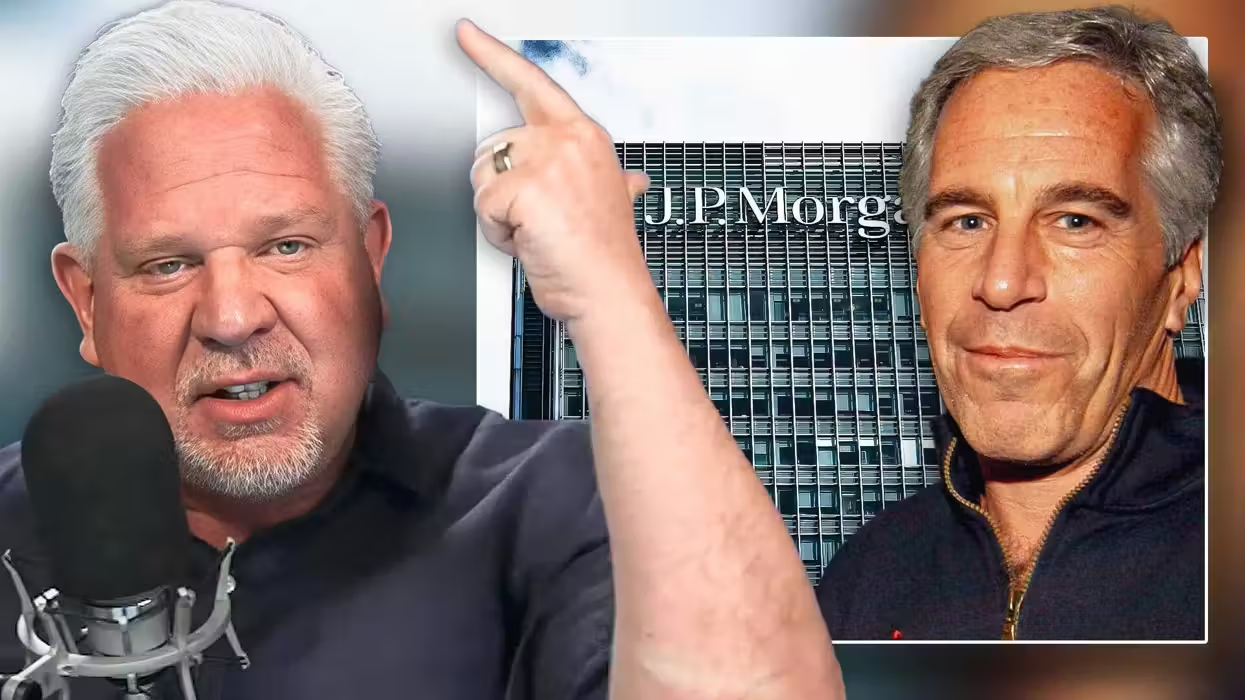

But Glenn Beck says “the real story” about Epstein isn’t the clients; it’s “the money.”

Per newly unsealed JPMorgan court documents from a 2023 U.S. Virgin Islands lawsuit, between 2002 and 2019 — despite ending Epstein's accounts in 2013 amid red flags — JP Morgan Chase filed just seven Suspicious Activity Reports on Epstein. It flagged only $4.3 million, while overlooking roughly 5,000 more suspicious transactions totaling over $1.3 billion, which were linked to potential sex trafficking, massive cash withdrawals, wires to Russian banks, and payments to or from high-profile Epstein associates.

“Let me just say this clearly so nobody really misses the gravity of this,” says Glenn. “You do not accidentally forget to report 5,000 suspicious wires. ... You don't misplace a billion dollars in wires to foreign banks and shell companies connected to a convicted sex offender under federal investigation. It doesn't happen.”

“It doesn't happen because a junior banker made a mistake. It doesn't happen because the compliance officer was sleepy. It doesn't happen because somebody's inbox was full. ... At a minimum: multiple officers, multiple departments, multiple sign-offs [chose] not to look.”

Why? Because “the bank decided, ‘Well, we want to continue to work with Epstein. He's valuable; he's connected; he's a referral engine to some of the richest people in the world,”’ says Glenn, arguing that somebody turned off the alarm bells on Epstein’s account.

“I'd like to know who turned those off. I'd like to know why they were turned off. I would like to know if it was just the leadership of the bank. I'd like to know that every single one of those bank officers all the way to the top go to prison,” he says.

“If you or I did this — if we had sent just a handful of suspicious wires — the bank would freeze your account, notify the Treasury before you could blink. But Jeffrey Epstein? A billion dollars' worth of exceptions.”

The most “terrifying question” we should all be asking ourselves right now, Glenn says, is this: “If a bank can look the other way on $1.3 billion for a sex trafficker, what else have the banks learned to ignore?”

“This story isn't just about Epstein. This is about the machinery that allowed him to operate — all of the middlemen, all of the financial networks, all of the institutions that treated him like an asset instead of a criminal,” he says.

To hear more of Glenn’s analysis and his Epstein theories, watch the clip above.

To enjoy more of Glenn’s masterful storytelling, thought-provoking analysis, and uncanny ability to make sense of the chaos, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.

BlazeTV Staff