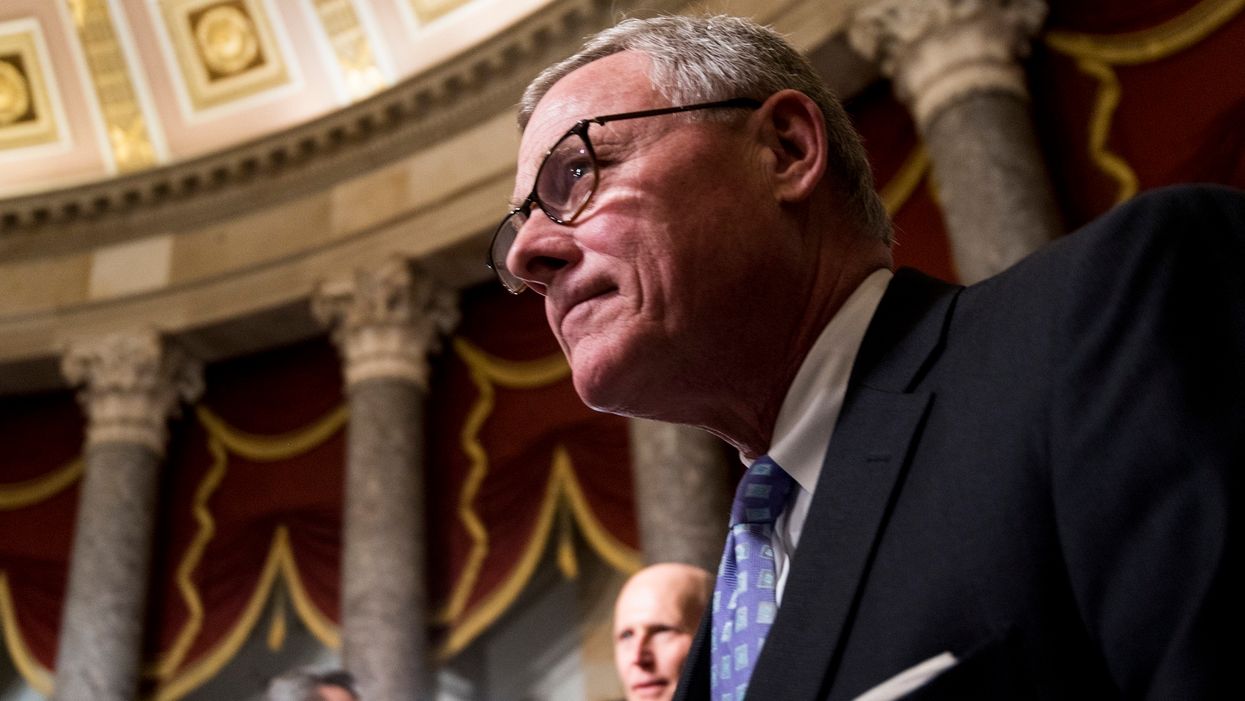

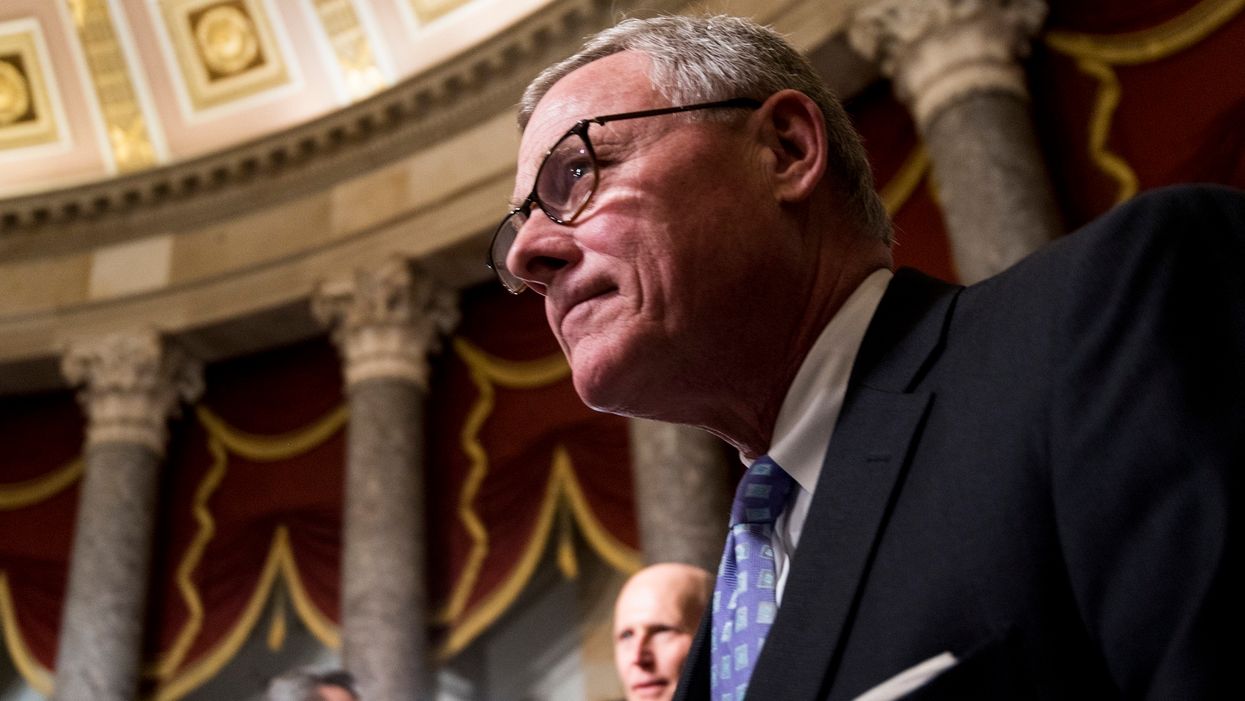

Sen. Richard Burr (R-NC)/(Bill Clark/CQ-Roll Call, Inc via Getty Images)

Sen. Richard Burr (R-NC) reportedly 'sold off a significant percentage' of his holdings in one day

Senate Intelligence Committee Chairman Richard Burr (R-N.C.) has come under fire after financial disclosures show the North Carolina Republican sold off somewhere between $628,000 and $1.72 million in stocks the week before markets tanked because of the coronavirus.

ProPublica reported Thursday that Burr "sold off a significant percentage of his stocks" — as much as $1.72 million worth — "on Feb. 13 in 33 separate transactions." An earlier version of the ProPublica piece estimated the selloff to have been as much as $1.6 million, but the outlet found more transactions after further digging.

The publication pointed out that "a week after Burr's sales, the stock market began a sharp decline and has lost about 30% since."

The news of Sen. Burr's selloff came while he was already taking heat Thursday over an NPR story published earlier in the day, citing a "secret recording" of the North Carolina Republican warning constituents during a private speech on Feb. 27 that COVID-19 "is more aggressive in its transmission than anything that we have seen in recent history."

NPR reported that Sen. Burr's remarks "were more stark than any he had delivered in more public forums" and wrote that on the same day, "President [Donald] Trump was tamping down fears and suggesting that the virus could be seasonal."

In response to the NPR article, Sen. Burr sent out a series of tweets Thursday afternoon, calling the story "a tabloid-style hit piece" and defending himself with documents showing that the Trump administration had, indeed, warned the public to prepare for disruptions stemming from the coronavirus during a news conference on Feb. 26 and elsewhere.

The senator added, "The message I shared with my constituents is the one public health officials urged all of us to heed as coronavirus spread increased."

Sen. Burr did not address his Feb. 13 stock sales in his Twitter thread regarding the NPR piece.

When asked by Politico about Burr's selloff, a spokesman for the senator issued a statement saying:

Senator Burr filed a financial disclosure form for personal transactions made several weeks before the U.S. and financial markets showed signs of volatility due to the growing coronavirus outbreak. As the situation continues to evolve daily, he has been deeply concerned by the steep and sudden toll this pandemic is taking on our economy. He supported Congress' immediate efforts to provide $7.8 billion for response efforts and this week's bipartisan bill to provide relief for American business and small families.

Several respondents on social media noted that the fact that the senator profited prior to the market volatility is precisely why he was facing scrutiny, likening his actions to insider trading.

Critics from the left and the right lashed out against Burr after the ProPublica story was published.

Charlie Kirk, president of conservative group Turning Point USA tweeted, "Shameful: While Richard Burr was receiving daily briefings on the Chinese Virus and reassuring Americans that the government was well equipped to handle the virus...He was also selling off $1.6 million in stocks which later tanked. Should conservatives be okay with this?"

Far-left Rep. Alexandria Ocasio-Cortez (D-N.Y.) tweeted, "As Intel chairman, @SenatorBurr got private briefings about Coronavirus weeks ago. Burr knew how bad it would be. He told the truth to his wealthy donors, while assuring the public that we were fine. THEN he sold off $1.6 million in stock before the fall. He needs to resign."