© 2025 Blaze Media LLC. All rights reserved.

Stocks managed to close up today:

▲ Dow: +0.28 percent▲ Nasdaq: +0.68 percent

▲ S&P: +0.43 percent

Precious metals:

▲ Gold: +0.38 percent to $1,725.30 an ounce▲ Silver: +1.56 percent to settle at $34.23

Commodities:

▲ Oil: +1.20 percent

Markets were up because:

Optimism that a budget deal will be reached in Washington sent stocks modestly higher Thursday. A pair of economic reports also brightened the mood.

The Dow Jones industrial average rose 36.71 points to close at 13,021.82.

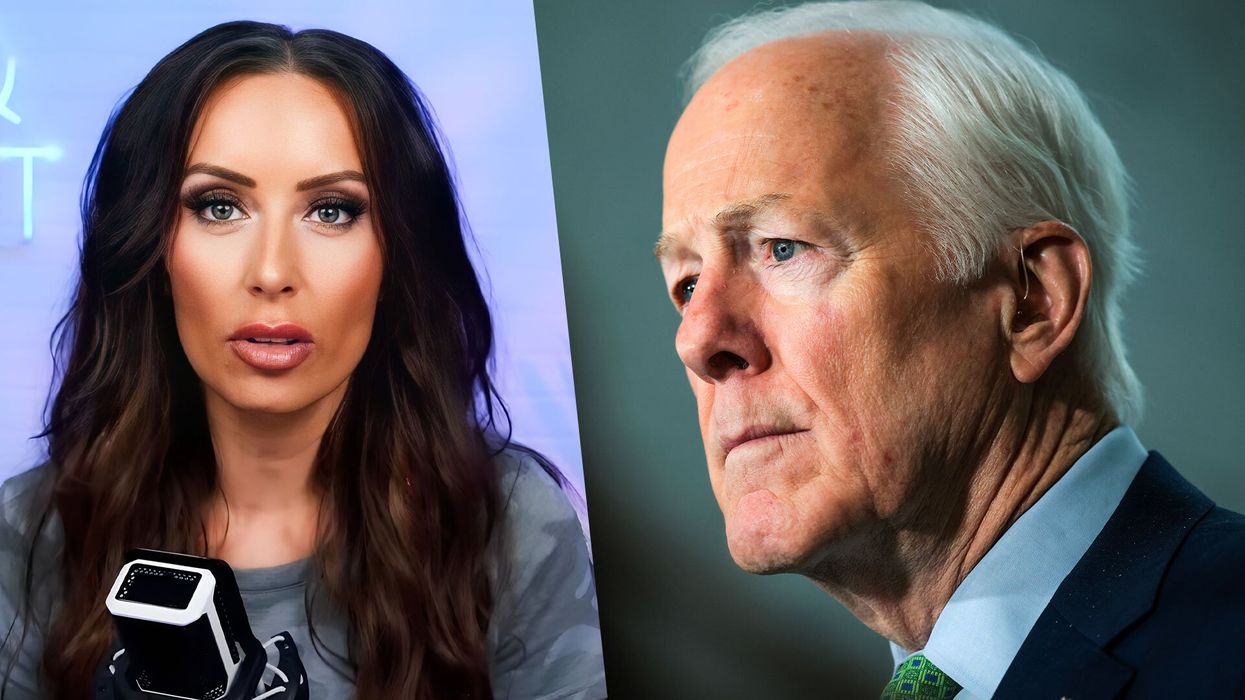

The stock market took a brief turn lower when House Speaker John Boehner said little progress was being made in budget talks in Washington. The Dow was up as much as 77 points in morning trading, turned negative as Boehner made his remarks at 11:30 a.m., then slowly recovered in the afternoon.

Investors were encouraged by several positive economic reports, including a higher estimate of third-quarter U.S. economic growth, an increase in home sales and a drop in claims for unemployment benefits.

After a meeting with Treasury Secretary Tim Geithner, Boehner told reporters that Democrats still haven't said which cuts they would accept to government benefit programs, suggesting a final budget deal remains a long way off. Republicans have said that they are open to increasing tax revenues as part of an agreement but only if they're accompanied by significant cuts to spending.

Investors have been closely watching the talks between the White House and Congress over the "fiscal cliff,” a reference to sharp government spending cuts and tax increases scheduled to start Jan. 1 unless a deal is reached to cut the budget deficit. New developments in the talks have whipsawed the market.

In other trading, the Standard & Poor's 500 rose 6.02 points to 1,415.95. The Nasdaq composite index gained 20.25 points to 3,012.03.

In the market for government bonds, the yield on the 10-year Treasury note slipped to 1.62 percent from 1.63 percent late Wednesday.

Dividends, now taxed at 15 percent, will be treated like ordinary income next year unless Congress and the White House extend current tax breaks as part of a budget deal.

The Commerce Department raised its estimate for U.S. economic growth to an annual rate of 2.7 percent in the July-through-September period.

The Labor Department also reported that the number of Americans applying for unemployment benefits dropped to 393,000 last week.

The Associated Press contributed to this report.

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2025 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.