© 2026 Blaze Media LLC. All rights reserved.

Coda Holdings filed for bankruptcy reorganization. It sold only about 100 of its electric cars. (Nate Napierala.)

Coda Holdings filed for bankruptcy reorganization. It sold only about 100 of its electric cars. (Nate Napierala.)

Electric car maker CODA Holdings Inc. filed for bankruptcy protection Wednesday after selling just 100 cars and said it plans to quit the auto business altogether.

“Coda’s bankruptcy is at least the third by an electric vehicle-related company in just over a year,” Bloomberg notes.

“A123 Systems Inc. (AONEQ), a battery supplier to Fisker Automotive Inc., another California-based maker of electric cars, filed for bankruptcy in October. Ener1 Inc., also a maker of batteries for electric cars, entered bankruptcy in January 2012,” the report adds.

It’s important to note that although A123 and an Ener1 unit were recipients of fed cash, Coda was not.

“The company applied for a $334 million loan in May 2010 and withdrew the request in April 2012,” Bloomberg explains.

“After two years of uncertainty, we needed to move forward with our business plan independent of the loan,” Matt Sloustcher, a Coda spokesman, said in an e-mail Thursday.

The Los Angeles-based parent of CODA Automotive filed for Chapter 11 bankruptcy protection in federal court in Delaware. A consortium of debtors plans to acquire CODA for $25 million, according to a company statement.

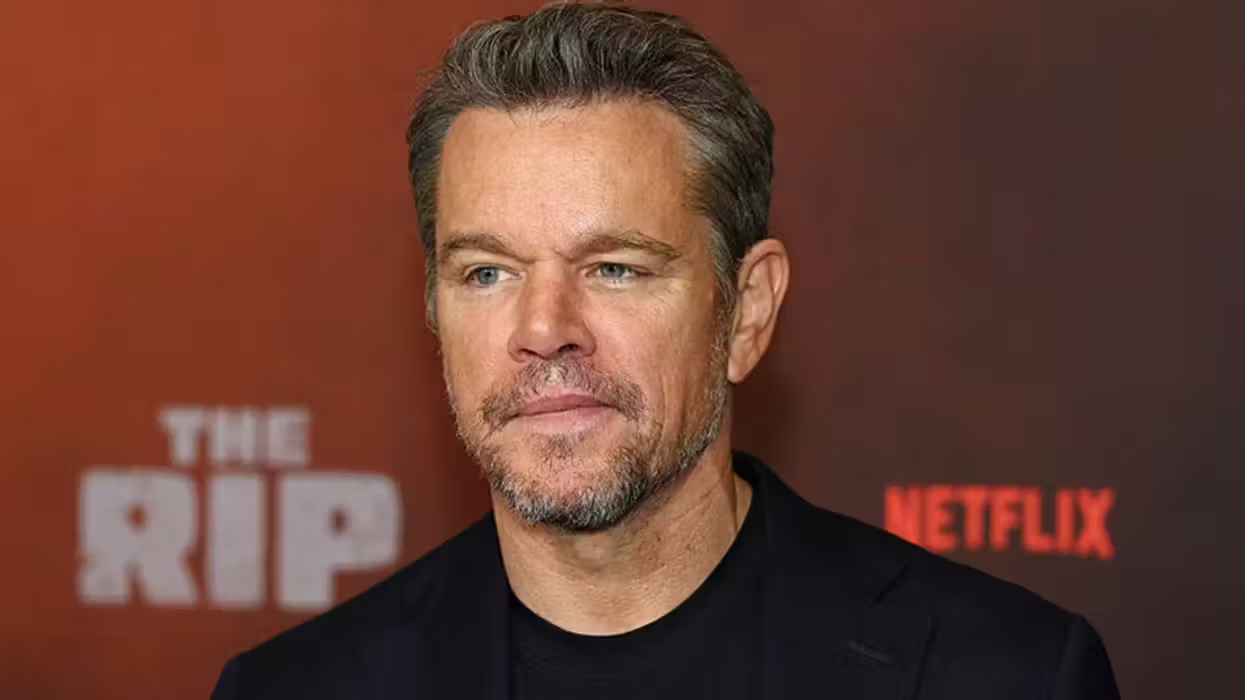

Getty Images.

Getty Images.

The company's statement said it plans to concentrate on CODA Energy, an energy storage business founded two years ago.

The 4-year-old company now has 40 workers. It furloughed around 50 but says it will call them back when the sale is completed.

CODA's business plan of marketing to private consumers was unrealistic because it pitted the startup against established players, said Phil Gott, senior director of IHS Automotive, an auto forecasting and advisory firm.

"They're not alone," he said. "I just think they're the latest victim of very big dreams and very shallow pockets."

"It speaks to people with, let's say, an unrealistic view of what it takes to enter ... the car business," Gott said. "People don't buy technologies. They buy utility, they buy style, they buy convenience, they buy service, they buy warranty support.

"People who say `I have a great new technology,' the best thing to do ... is to sell it to someone who's already got all of the other things you don't have," he said.

Buoyed by hundreds of millions of dollars in backing, CODA moved from Santa Monica and opened its 100,000-square-foot global headquarters in Los Angeles in the fall of 2011.

Coda was based in Los Angeles and its cars had their electric systems installed in Benicia Calif. (AP.)

Coda was based in Los Angeles and its cars had their electric systems installed in Benicia Calif. (AP.)

Last year, its plant in the Northern California town of Benicia began rolling out its five-passenger sedan. It had a single-charge range of up to 125 miles. The car's battery, body and most other components were made in China and assembled in California.

The company had big plans, estimating it would sell 10,000 to 14,000 vehicles in its first 12 months. Instead, it sold around 100.

Its sticker price of $37,250 -- reduced to $27,250 with federal credits and state rebates for electric vehicles -- coupled with a lengthy recharge time of six hours and humdrum styling failed to attract buyers.

Investors also became wary, and a proposed $150 million securities offering resulted in less than $22.5 million, according to a Securities and Exchange Commission filing last year.

CODA's troubles are simply growing pains for an embryonic technology, Gott said.

"In about a decade or so it'll be really ready for the consumer," he said.

--

Follow Becket Adams (@BecketAdams) on Twitter

The Associated Press contributed to this report.

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2026 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.