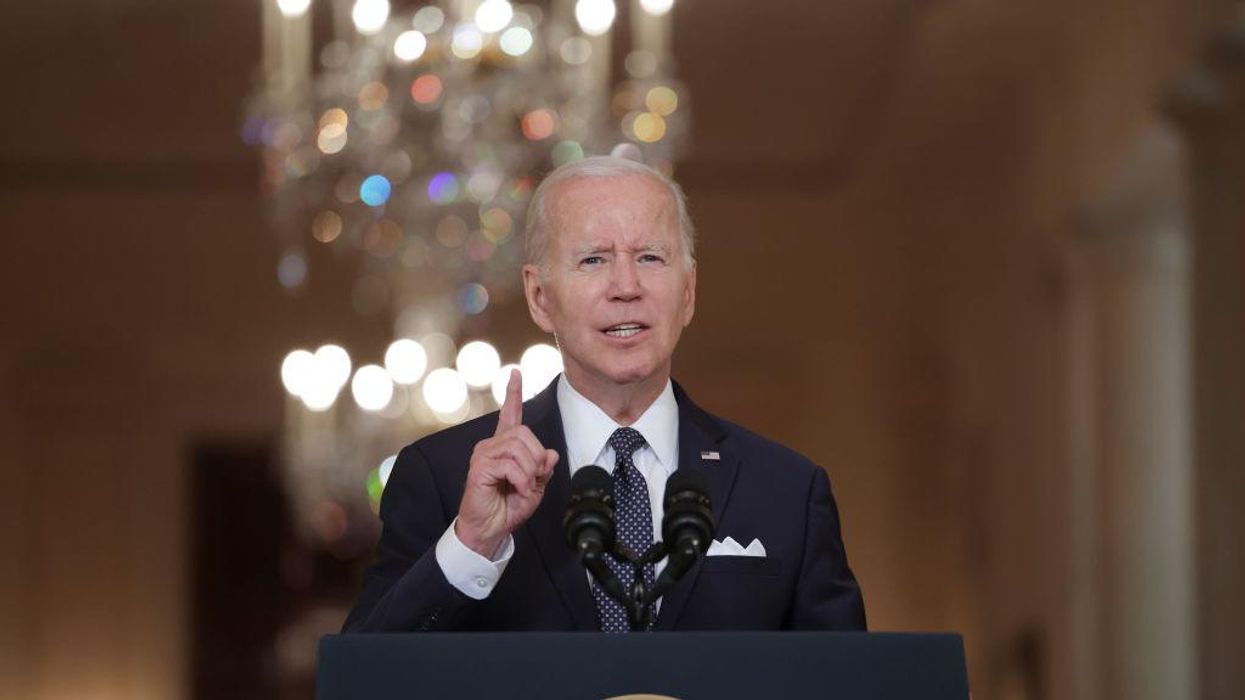

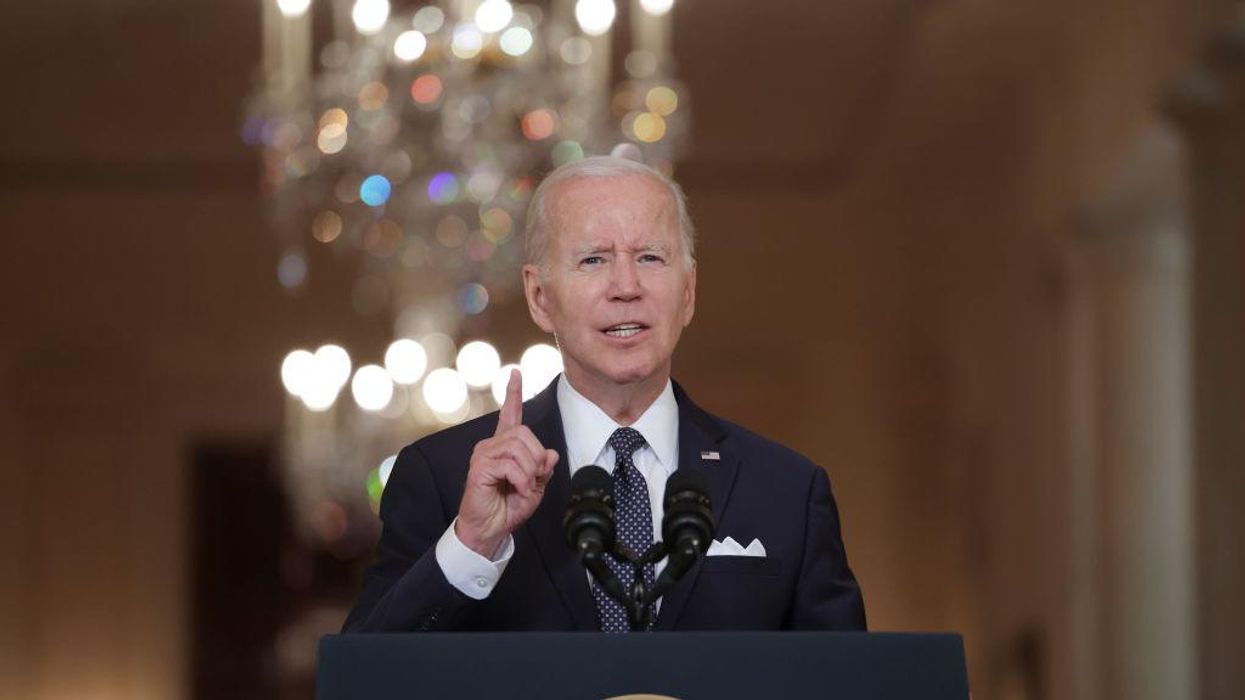

Photo by Kevin Dietsch/Getty Images

President Joe Biden announced on August 24 that by executive action, he would wipe out a significant amount of the debt consensually entered into by tens of millions of Americans. The White House offered a cost estimate of $24 billion a year over ten years. A recent report from the Congressional Budget Office indicates that the Biden administration's $240 billion figure is nowhere close to the likely cost of the plan.

As of June 30, 2022, 43 million debtors held $1.6 trillion in federal student loans. Biden's executive action would have those earning less than $125,000 per year see $10,000 of their debt canceled and Pell grant recipients see $20,000 of their debt paid down by taxpayers.

A September 26 report released by the nonpartisan Congressional Budget Office indicated that:

This student loan forgiveness action is reportedly the costliest of Biden's executive orders to date, which have cumulatively cost taxpayers over $1 trillion.

On Monday, Maya MacGuineas, the president of the Committee for a Responsible Federal Budget, called the cost "outrageous," suggesting it could exceed "$510 to $610 billion with their [income-driven repayment] changes. The Biden Administration's failure to release their own cost estimate should have been a red flag."

The Biden administration's proposed income-driven repayment plan is estimated to cost between $90 billion and $190 billion.

MacGuineas stressed the plan's problematic nature: it "would wipe out the ten-year savings from the Inflation Reduction Act twice over, worsen inflationary pressures, and deliver benefits to millions of Americans with advanced degrees in upper-income households. ... It's unacceptable that the President would implement it without offsets and without Congressional approval."

Democrat Sens. Chuck Schumer (N.Y.) and Elizabeth Warren (Mass.) suggested that the CBO's estimate, twice what the White House had initially indicated, "makes clear that millions of middle class Americans have more breathing room thanks to President Biden's historic decision to cancel student debt."

In a September 12 Newsweek op-ed, former U.S. Secretary of Education Betsy Devos wrote: "However you add it all up, it's an unprecedented amount of spending, all brought about by executive fiat. ... This brazen and unconstitutional 'forgiveness' decree will be challenged and will lose in court."

Devos claimed, "The move was meant to buy votes, not reform lending or solve a problem."

Rep. Elise Stefanik (R-N.Y.) suggested that Biden's plan will greatly exacerbate inflation.

Recent estimates indicate that, owing to inflation, the average American household now has to spend $11,500 just to maintain the same living standard as in past years.

Rep. Scott Fitzgerald (R-Wis.) suggested that forcing "87% of Americans who don't have student loan debt to pay for $500 billion in debt (CFRB) held by mostly high-earners is a slap in the face."

Sen. Tom Cotton (R-Ark.) intimated Biden's program is a penalty on the American working class.

Sen. Richard Burr (R-N.C.) concurred, stating, "Every American should be outraged by the president's cynical ploy and by the real cost it places on those who stand to benefit the least."

White House press secretary Karine Jean-Pierre suggested that criticism of Biden's plan was tantamount to "noise."