Nathan Posner/Anadolu Agency/Getty Images

Unlike the COVID lockdowns of 2020, ordinary Americans will feel no effects from a temporary lapse in federal appropriations. Nevertheless, our lives are completed contorted by the existing government shutdowns today. You may not recognize them as “shutdowns.” It’s really just the government printing so much money and saddling us with so much debt that the standard of living from two generations ago has become a luxury.

Who will end that shutdown?

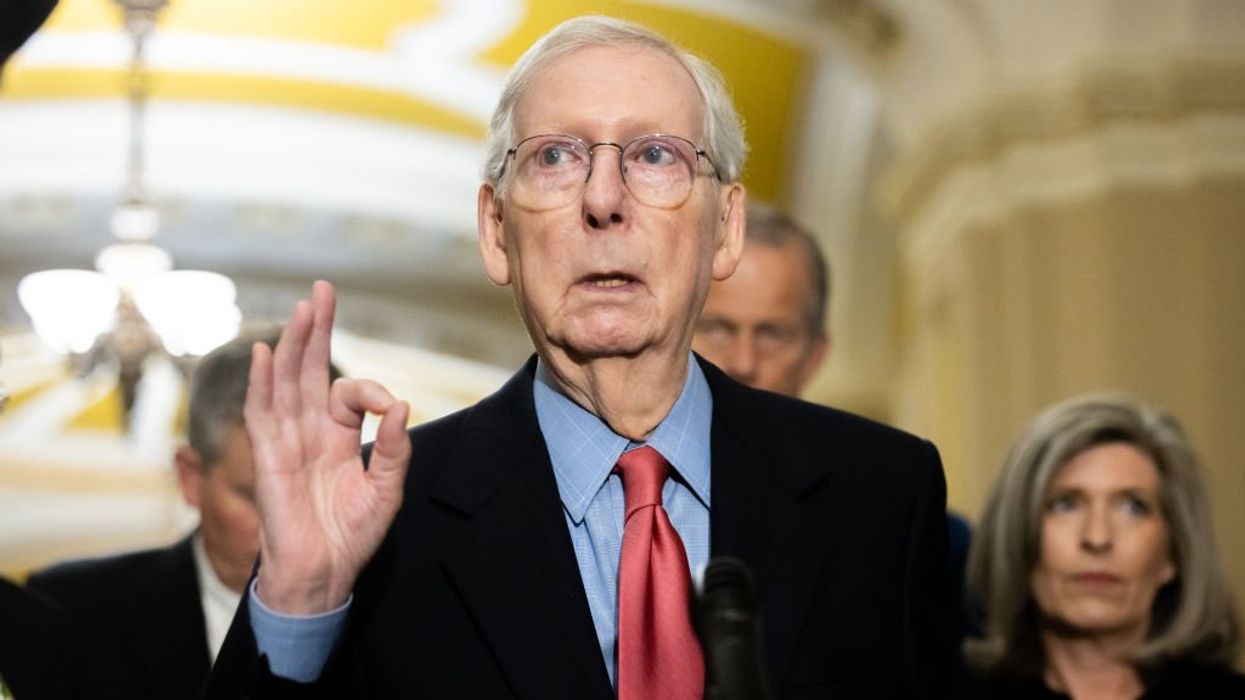

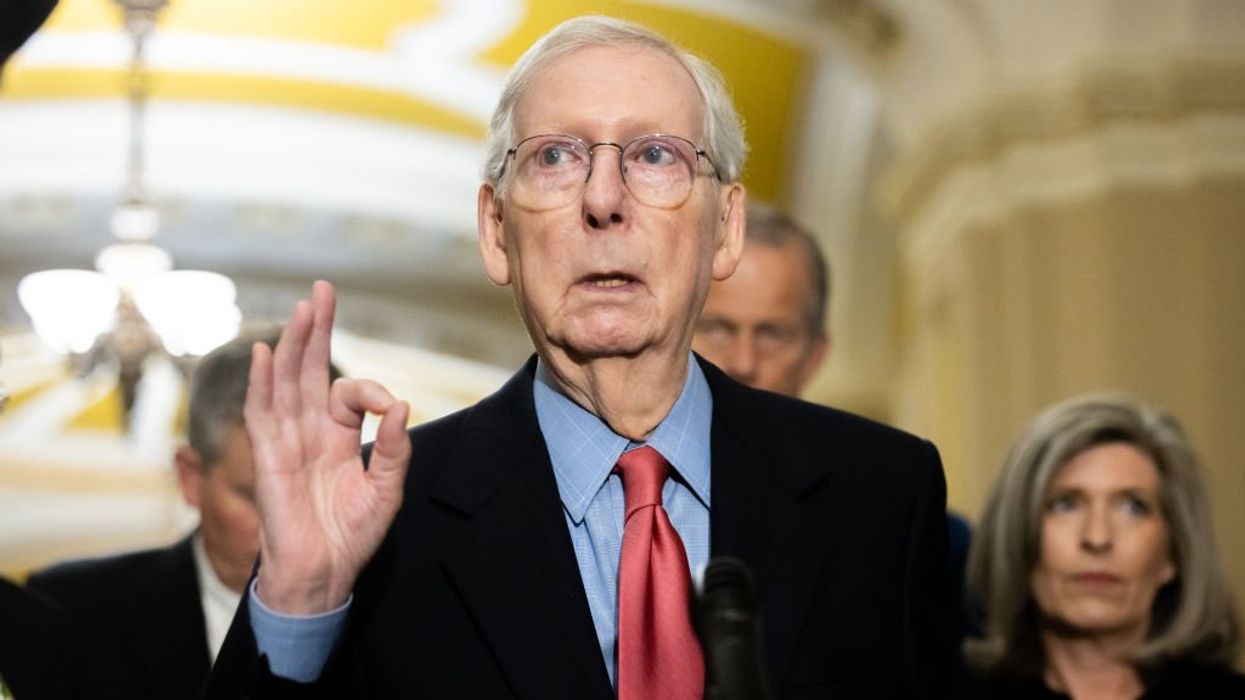

Senate Minority Leader Mitch McConnell (R-Ky.) thinks we can just pass a “standard” continuing resolution (except for extra Obamacare and Ukraine funding, of course), and we will avoid a shutdown. What he hasn’t explained, though, is how our society can last another year with $2 trillion deficits — $1 trillion on interest alone — driving up the cost of living to the point where practically everyone is suffering a lifestyle shutdown. If not in the budget, then where else will we have this debate and rectify the problem?

If we were to go down the McConnell status quo path, it would mean reckoning with an inescapable death trap between endless debt and interest constantly reinforcing inflation and continually driving up interest rates, which would further exacerbate each other in the ultimate fiscal death spiral.

For the first time in history, we’re now incurring all of the detriments of high interest rates without any of the benefits. The last time rates were this high, government budget deficits were a fraction of their current size. Nowhere is this more evident than with housing.

The total value of the U.S. housing market is 49% higher than before the COVID spend-a-thon. Everyone thought rising interest rates would at least lower the prices, but instead they created a mortgage cliff between existing owners and buyers so that nobody wants to sell his low-mortgage home for one with a much higher rate.

This is why home sales are down more than 18% this year so far.

Mortgage rates have not been this high since 2000. But back then, we were running fiscal surpluses, not perpetually gargantuan deficits. Inflation was no concern. We also were not coming off record low interest rates designed arbitrarily to fund the COVID lockdowns, which, in turn, created a precipitous mortgage rate cliff we’ve never seen before.

What 20- or 30-something head of a family could afford to purchase a first home? The average sale price for a home in the United States today is $514,000. Aside from coming up with more than $100,000 for a down payment, monthly payments at 7.5% interest would top $2,875 a month.

In addition, rising prices are driving up taxes and insurance, which could easily add another $500 or $600 a month to a middle-class homeowner’s considerable expenses. That means a family of four earning roughly $100,000 a year would see close to $3,500 out of $5,900 monthly net income go to housing.

This represents 59% of income, roughly double the 28% standard set forth in the mortgage industry for household fiscal solvency. Obviously, that’s unsustainable. One would need an income of more than $235,000 a year to remain under the 28% share of the cost of housing. For most people, that would likely only occur in higher-cost areas where houses are even more expensive. And this is all before we account for an extra $709 in monthly living expenses.

None of this is going away, and it will only get worse as more debt matures at higher interest rates. Treasury yields have gone up nearly every day over the past two weeks, despite no expectation of another federal fund rate increase in the coming weeks. Looks can be deceiving.

The trap between endless debt-driven inflation and rising interest rates is like a runaway train speeding down a hill. Unlike in previous eras of dramatic spending increases, nearly all the new spending from COVID was financed through debt rather than taxes. As former White House budget policy director Paul Winfree observes, only between 4% and 7% of the spending increases since COVID have been financed with tax revenue. During World War II, that number was 30%. This means that almost all the new spending will be paid for in the form of money creation, aka inflation and maturing Treasuries at higher interest rates.

Just in the two weeks since the gross federal debt crossed $33 trillion, we have added an additional $12 billion per day, an annualized pace of $4.4 trillion in additional debt! In less than three months since the “largest spending cuts in American history,” we’ve added $1.7 trillion in debt, the quickest at any time in history other than the Cares Act. Thus, Treasury yields will skyrocket commensurate with the debt issuance. Which means the American dream is dead – not just for our children and grandchildren, but for us today.

In other words, we have the greatest shutdown of a society, economy, and civilization imaginable. What is the plan to reopen it?

Fear not! Fearless Leader Mitch McConnell believes that any budget brinksmanship “would actually take the progress we’ve made on key issues and drag it backwards.” What you consider an economic collapse, McConnell lauds as progress — so long as those venerable HUD and Department of Education workers don’t miss a few weeks of back-paid vacation with the cost-of-living adjustments you will never see.

Daniel Horowitz

Blaze Podcast Host