© 2025 Blaze Media LLC. All rights reserved.

Nothing demonstrates the insufferable nature of Washington politics more than the current debt ceiling debate — or rather, the lack thereof.

It is now official: The GOP is as fiscally conservative as it is socially conservative … which is more liberal than even the Democrats of last generation ever were.

The leaders of both parties in Congress and the supposed-Republican president all agree on the same goal — the problem is not the debt itself but the debt ceiling law designed to constrain the debt. Their only disagreement was over the minutiae of how to fool the people and dispense with the sheriff (the debt ceiling) rather than tackling the criminal (the immoral debt burden).

Rather than enact what any family would do at this dire juncture — a plan to get out of debt — the Swamp went looking for another blank check and limitless credit card. And they got it. The blank check passed the Senate 80-17 and the House 316-90.

Where’s the common sense? Where’s the empathy for our children and grandchildren?

Even worse, Trump is now reportedly forming an alliance with Democrats to abolish the debt limit law altogether. Such a move would eliminate the last effective tool to constrain government, reverse the mortgage of our children’s future, and lift the current burden of debt that is weighing down economic growth.

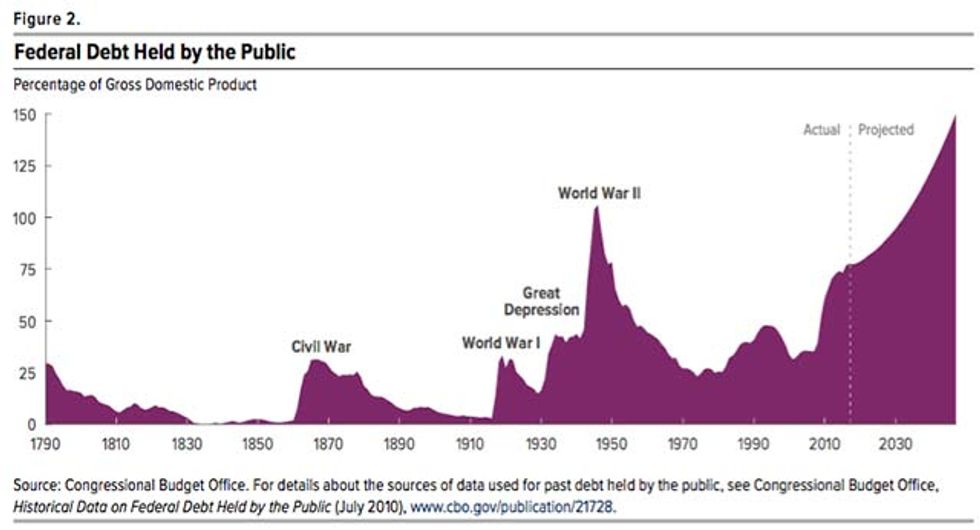

Our history is one of almost no debt

Before the modern era of politics, there was a bipartisan consensus to avoid debt like the plague. In his farewell address, George Washington exhorted the politicians to avoid “the accumulation of debt not only by shunning occasions of expense but by vigorous exertions … to discharge the debts … not ungenerously throwing upon posterity the burden which we ourselves ought to bear.”

James Madison warned that “public debt is a public curse, and in a Republican Government a greater than in any other.” Even the “big government” champion of the time, Alexander Hamilton, declared that “nothing can more affect national prosperity than a constant and systematic attention to extinguish the present debt and to avoid as much as possibly the incurring of any new debt.”

During the first 130 years of our republic, our political leadership more or less abided by this principle and strove to avoid or immediately pay off any debt. Even during times of war, which was practically the only time debt was accrued in significant amounts, the political leaders stepped up to the plate.

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

Blaze Podcast Host

Daniel Horowitz is the host of “Conservative Review with Daniel Horowitz” and a senior editor for Blaze News.

RMConservative

Daniel Horowitz

Blaze Podcast Host

Daniel Horowitz is the host of “Conservative Review with Daniel Horowitz” and a senior editor for Blaze News.

@RMConservative →more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

Related Content

© 2025 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.